Get free access to

Our legislation updates make it easy for you to keep on top of the latest changes affecting your business. Receive our articles, opinions, tips, industry news, country profiles, regional overviews and studies, latest events and even more, directly into your mailbox.

Check out our Newsroom to see what is included!

We will send you only relevant information we consider may be of your interest and treat your personal data in compliance with our Privacy policy and GDPR statement.

Unable to subscribe? Try this page.

Updated on 13th of February, 2025

On 30 January 2025, an amendment to Act No. 65/2022 Coll. and related acts relating to the conflict in Ukraine was submitted for signature by the President of the Czech Republic. The amendment plays a key role for companies looking to employ refugees from Ukraine in the Czech Republic, as it grants foreigners special protection and free access to the labour market. Thanks to the changes, temporary protection is to be extended again until 31 March 2026.

Persons who have fled from Ukraine before the armed conflict can currently reside in the Czech Republic on the basis of different types of residence permits. In addition to ordinary residence permits, such as an employment card, a large number of Ukrainian citizens reside in the Czech Republic on the basis of:

Please note that, with a few exceptions, it is not possible to apply for another residence permit after the start of the conflict. The only exceptions are applications covered by Government Regulation No. 308/2022 Sb. According to this regulation, it is possible to apply to the embassy in Ukraine for, for example, a blue card or a permit for the purpose of study.

Embassies in Ukraine are also now accepting applications for employment cards, but only for government-approved programmes (e.g. Skilled Worker Programme, Key and Scientific Personnel Programme, etc.).

For more information on the conditions for inclusion in the economic migration programme, please click here.

Temporary protection will be extended again by affixing a new visa. Given that it is not technically possible to extend temporary protection in a single day, the process will again take place in two steps, first by registration and then by visiting the Ministry of the Interior (OAMP).

Online registration will take place on the website of the Ministry of the Interior and will be possible until 15 March 2025.

By registration itself, the temporary protection will be extended until 30 September 2025. Registration must be completed by booking an appointment to visit the Ministry of the Interior.

Data on family relations will also be filled in as part of the registration. Specifically, it will be necessary to fill in information about the spouse and children under 18 years of age, who are also holders of temporary protection.

After online registration, it is necessary to arrive at the booked date at the Ministry of the Interior and collect new visa. The visit to the OAMP must be completed by 30 September 2025. A foreigner needs to bring:

New visa will be valid until 31 March 2026.

Holders of a visa for the purpose of toleration in connection with the conflict in Ukraine will have their visas automatically extended again, until 31 March 2026. They do not have to take any further steps.

However, to avoid inconsistencies and uncertainty when dealing with the authorities, we recommend that you apply for a new visa with an updated validity date. This requires an appointment at OAMP.

We would like to remind you that the employer of a foreigner is obliged, among other things, to keep a copy of the documents proving the employee’s right to reside. The employer should therefore be concerned with whether employees who hold temporary protection have applied for its extension properly and in time.

Employers are advised to ensure that their employees register on time and then attend the appointment for the visa to be affixed. The registration will be supported by a pdf certificate which can be downloaded from the OAMP portal.

Temporary protection holders have free access to the labour market, so they do not have to deal with work permits (unlike, for example, holders of a tolerance visa).

In addition to matters related to the extension of residence titles, please note that the foreigner is obliged to report to the OAMP any significant changes concerning him/her, e.g. change of residence address, change of surname, change of marital status or change of travel document. Find the form on the OAMP’s website for this purpose. The form shall be delivered along with the necessary documents in person, sent by post or by data box.

Foreigners should also note that they may be subject to obligations such as paying utilities or health insurance.

We are ready to help you with the employment of refugees from Ukraine, do not hesitate to contact us or browse through our services in the Czech Republic.

Persons who have fled from Ukraine before the armed conflict can currently reside in the Czech Republic on the basis of different types of residence permits. In addition to ordinary residence permits, such as an employment card, a large number of Ukrainian citizens reside in the Czech Republic on the basis of:

Please note that, with few exceptions, it is not possible to apply for another residence permit. The only exceptions are applications covered by Government Regulation No. 308/2022 Sb. According to this regulation, it is possible to apply to the embassy in Ukraine for, for example, a blue card or a study permit.

Embassies in Ukraine are also now accepting applications for employment cards, but only for government-approved programmes (e.g. Skilled Worker Programme, Key and Scientific Personnel Programme, etc.).

For more information on the conditions for inclusion in the economic migration programme, please click here.

Temporary protection will be extended again by affixing a new visa. As it is not technically possible to extend temporary protection in one single day, the process will be carried out in two steps, first by registration and then by a visit to the Asylum and Migration Policy Department of the Ministry of the Interior (OAMP).

If the holder of temporary protection fails to register by the deadline or fails to present the visa after registration by the end of September 2024, the temporary protection will expire.

Online registration will be open until 15 March 2024. The registration portal will be available on the following website: www.frs.gov.cz/docasna-ochrana/#3.

The registration itself extends the temporary protection until 30 September 2024. However, it is necessary to complete the registration by booking a date to visit the Ministry of the Interior.

If the registration is not done in time and the temporary protection expires, the foreigner has the possibility to reapply for temporary protection. However, there is a risk of not being found to meet the conditions for its granting.

After registering online, it is necessary to arrive at the OAMP on the scheduled date and have a new visa marked. The visit to the OAMP must

be completed by 30 September 2024. The foreigner should submit following documents:

New visa will be valid until 31 March 2025.

For holders of a visa for the purpose of tolerance in connection with the conflict in Ukraine, the visa will be extended again automatically until 31 March 2025. There is no need to take any further steps to do so. The visa for the purpose of tolerating the conflict in Ukraine is coded D/SD/91.

However, to avoid inconsistencies and uncertainty when dealing with the authorities, we recommend applying for a new visa with an updated validity date. This requires an appointment at OAMP.

We would like to kindly remind that the employer of a foreigner is obliged to keep a copy of the documents proving the employee’s right to stay. Therefore, the employer should be concerned with whether employees who hold temporary protection have properly and timely applied for its extension.

Employers are advised to ensure that their employees register on time and then attend the appointment for the visa to be affixed. The registration will be supported by a pdf certificate which can be downloaded from the OAMP portal.

Temporary protection holders have free access to the labour market, so they do not have to deal with work permits (unlike, for example, holders of a tolerance visa).

In addition to matters related to the extension of residence titles, please note that the foreigner is obliged to report to the OAMP any significant changes concerning him/her, e.g. change of residence address, change of surname, change of marital status or change of travel document. Find the form on the OAMP’s website for this purpose. The form shall be delivered along with the necessary documents in person, sent by post or by data box.

Foreigners should also note that they may be subject to obligations such as paying utilities or health insurance.

We are ready to help you with the employment of refugees from Ukraine, do no

Persons who have fled from Ukraine before the armed conflict can currently reside in the Czech Republic on the basis of different types of residence permits. In addition to ordinary residence permits, such as an employment card, a large number of Ukrainian citizens reside in the Czech Republic on the basis of:

This type of residence will generally be given to those who fled Ukraine after the invasion by the Russian Federation. Alternatively, those whose residence permits have expired but cannot return for the time being due to the situation in Ukraine.

Please note that persons who have obtained temporary protection in another Member State cannot obtain temporary protection in the Czech Republic. At present, it is not even possible for persons with temporary protection or a visa for the purpose of toleration to switch to the employment card regime.

The most significant change is the possibility for persons with temporary protection granted in another country to apply for a blue card at the embassy in Ukraine.

We would like to remind you that holders of temporary protection issued by the Czech Republic can only stay in the Schengen area countries in a limited regime according to the so-called 90/180 rule. Thus, within any 180 days they can stay outside the territory of the Czech Republic in another Schengen area country only for 90 days.

Temporary protection was granted until March 31, 2023. Those who wished to continue to reside in the Czech Republic had to register online by March 31, 2023.

If the registration was not carried out, the temporary protection expired. In this case, the person can reapply for temporary protection. If he or she continues to meet the conditions, temporary protection will be granted.

If the registration has been duly and timely carried out, this extends the validity of the temporary protection until September 30, 2023. Until then, the holder of temporary protection is obliged to appear in person at the Asylum and Migration Policy Department of the Ministry of the Interior (OAMP) and have a new visa affixed. This will be valid until March 31, 2024. The date at the OAMP is assigned during online registration.

As part of the in-person visit to OAMP to mark the new visa, you must also provide the necessary documents. These are:

If the deadline for extending temporary protection has been missed, any entitlement to benefits (e.g. humanitarian benefits, housing assistance, free access to the labour market, access to health insurance) has also been lost.

The foreigner has the possibility to reapply for temporary protection if the circumstances that led to the first application continue to exist.

More information can also be found on the website of the Ministry of the Interior of the Czech Republic.

If you do not meet the conditions for temporary protection, you can apply for a tolerance visa. In this case, the person does not automatically have free access to the labour market and must obtain permission from the Labour Office.

Those who already have a tolerance visa in connection with the conflict in Ukraine have their visa extended automatically until 31 March 2024 and do not need to take any further steps. However, in order to avoid inconsistencies and uncertainty when dealing with the authorities, it is recommended to request a new sticker with an updated validity date. This label is marked with the code D/SD/91. A prior order is required for its marking.

There is also an exception for visas issued in connection with the armed conflict in Ukraine in relation to exit from the territory. Persons holding this type of visa for the purpose of toleration do not lose their visa by leaving the territory.

Since the employer is obliged to keep a copy of the documents proving the alien employee’s eligibility to stay, the employer should take a proactive interest in whether employees who hold temporary protection have applied for its extension in a proper and timely manner.

By March 31, 2023, temporary protection holders should have completed online registration. By doing so, they extended their temporary protection until September 30, 2023. They must then appear in person at an OAMP office to have their visa affixed by that date. The visa will be valid until March 31, 2024.

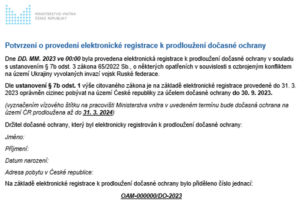

The employer can then verify the validity of the authorisation with the newly affixed visa. Between the online registration of the person with temporary protection and the affixing of the visa, the employer should request a confirmation of registration from the person with temporary protection in order to check his/her residence (see image). The registration number can be read from this confirmation. The employer can use the registration number to check the validity of the registration online.

As of April 1, 2023, employers are obliged to register all employees who have temporary protection with the CSSA. This obligation now also applies to employers who have a work performance agreement or a work activity agreement with a holder of temporary protection. The deadline for registering a person is normally 8 days.

Otherwise, the same rules apply to the employment of persons with temporary protection as to the employment of other foreigners with free access to the labour market, e.g. the employer’s obligation to report the start of employment of the foreigner and other changes to the Labour Office or to keep a register of foreign employees.

It’s possible to only employ Ukrainian refugees with free entry to the Czech labour market.

Free entry to the labour market means, that Ukrainian citizens and their family members which comply with conditions further described may work in the Czech Republic without any formal restrictions, i.e. without having to obtain a work permit in advance or the employer having to submit a job position vacancy form beforehand.

The Ukrainian citizen and his family members may work in an employment relationship, as well as on the basis of some of the agreements of performing work outside the employment relationship. Of course, the standard legal conditions must be adhered to, in particular minimal and guaranteed wage, length and schedule of worktime etc.

The Ukrainian refugee must be granted the temporary protection (or perhaps the special long-term visa, which was issued at the begging of the war conflict).

Temporary protection (special long-term visa) is marked with a sticker or stamp in the passport.

Until the above-mentioned law came into effect, Ukrainian refugees were granted a so-called special long-term visa. Since the effective date of the law, only the so-called visa for the purpose of temporary protection has been granted. According to information from the Ministry of the Interior, however, persons who obtained a special long-term visa before the effective date of the law will be automatically transferred to the temporary protection system, i.e. without having to take any action.

Temporary protection may be granted:

For the grant of temporary protection it’s necessary to file the submission personally at one of the District assistance centres for helping Ukraine – the list of these centres according to individual districts may be found HERE.

It’s advised that the Ukrainian citizens who don’t comply with the above-mentioned conditions to sort out their situation individually at the Department of Asylum and Migration Policy of the Ministry of Interior (contact points HERE).

Necessary documents to submit for the application:

The employer has the following administrative obligations:

The employer must have a record of information regarding the foreign employee in the extent:

In the language that the Ukrainian refugee understands, i.e. ideally a bilingual CZ/UA document.

The same rule applies to any other labour law documents of the employer which the Ukrainian refugee should be acquainted with.

The law nor any other legal regulation doesn’t impose this obligation upon the employer to retrieve the extract from the Criminal Records for this purpose and Ukrainian refugees are perceived as citizens of the EU.

In principle the temporary protection which as well means free entry to the labour market is only applicable in the Czech Republic, i.e. the holder of the temporary protection may not use this permit to work abroad.

Nevertheless, if the foreigner is posted within the framework of the Directive regarding posting of workers by his employer to a different entity for the purpose of performance of provision of services, the necessity to have a permit to perform work doesn’t apply to him in the Czech Republic. Nevertheless, it’s necessary to comply with other conditions according to the Directive regarding posting employees (e.g. information obligation, obligation to ensure certain equal working conditions etc.).

A similar regulation should also be applicable within harmonisation in the whole EU. However, it’s not excluded that some EU countries have made use of the possibility to apply an exception to this rule. Therefore, we recommend that you check the local regulation before sending the holder of the temporary protection to another EU country.

On the territory of the Czech Republic there are no limitations to performing business trips. However, on business trips foreigners should always have the necessary documents (mainly copy of the employment contract and travel document with the sticker/stamp proving temporary protection with them).

Yes, it’s necessary to comply with the registration obligation upon arrival and when the place of residence in the territory of the Czech Republic is changed.

For both cases the deadline is 3 days.

The registration upon arrival is done in person at one of the offices of the Foreign police.

The change of place of residence may be announced via post or at the appropriate office of the Department of the Asylum and Immigration Policy of the Ministry of Interior (territorial jurisdiction according to the new place of residence), when announcing this change the document confirming accommodation at the new address (see the forms above) must be submitted together with the form which is available here.

No, every EU Member State states its own rules for the performance of work of Ukrainian refugees. The temporary protection granted in the Czech Republic applies exclusively to the performance of work in the Czech Republic.

Yes, the entrance medical examination shall be performed before commencement of performance of work. In case there is not a chance to obtain the extract from medical records an extended medical examination must be performed.

Free entry is granted by law only temporarily, currently it’s valid till 31 March 2023. In case Ukrainian citizens will want to reside and work in the Czech Republic even after this date they will have to obtain the necessary permit in due time.

Of course, it can’t be ruled out that the effectiveness of the exemption will be extended as the situation evolves.

The limitation of the validity of the law doesn’t mean that the employment contract / agreements on work performed outside of employment must be concluded for a definite period. In our opinion, they may also be concluded for an indefinite period.

Firstly, it’s the failure to fulfil the duty to inform the Labour office when an employee commences performance of work, when the employee’s reported data changes or when the employee’s employment terminates (for more details, please see the question What are the obligations of the employer when hiring Ukrainian refugees?).

Secondly violation of the condition regarding retention of copies of documents proving the existence of employment relationship at the workplace, i.e. employment contract or agreements on work outside employment. An exception to this obligation is the situation when the employer has fulfilled the obligation to notify the District Social Security Administration of the date of the employee’s commencement of employment, which established the employee’s participation in sickness insurance under the Sickness Insurance Act (and therefore only from the moment of fulfilling this obligation) – the supervisory authority is entitled to obtain the relevant information from the Social Security Administration.

Another frequent violation of conditions which occurs during employment of Ukrainian refugees is enabling illegal work which primarily is

Lastly, the most frequently violated legal condition is the disguised employment placement of holders of temporary protection from Ukraine, when most likely the signs of job placement were fulfilled, but without the appropriate license of the employment agency or without the necessary documentation, typically disguised under a contract for work or a contract for the provision of services.

On 31 July 2024, an amendment to Act No. 226/2006 Coll., the Labour Code, was published in the Collection of Laws. It is mainly a transposition amendment to the Labour Code in the Czech Republic that incorporates the requirements of the European Union into the Czech legal system. However, other provisions relevant to labour law were also inserted by the amending legislative proposals.

The transposition amendment to the Labour Code in the Czech Republic brings several important changes that will affect both employers and employees. You may read below about the new mechanism for calculating the minimum wage, the abolition of the guaranteed wage in the private sector and other changes brought by this amendment.

Although the transposition amendment to the Labour Code in the Czech Republic was effective literally hours after its promulgation, there is no urgent need to rewrite contracts and agreements. Most of the changes are in fact applicable only from 2025; there are only a few changes that need to be or can be considered now.

From 1 August 2024, the following changes apply:

On the contrary, the following changes will only take place as of 1 January 2025:

The transposition amendment to the Labour Code in the Czech Republic introduces a new method of calculating the valorization of the minimum wage in accordance with the requirements of Directive (EU) 2022/2041 of the European Parliament and of the Council of 19 October 2022 on adequate minimum wages in the European Union.

The new valorization will be linked to the forecast of the average gross monthly wage for the calendar year for which the minimum wage is set. An indicative reference value of 47 % of the average gross wage in the national economy is set. The indicative reference value is not a target but serves for the purpose of comparing the current level of the minimum wage in relation to an assessment of its adequacy.

The minimum wage will thus rise in line with the increase in the ratio to the average wage in the national economy. Practically, this mechanism will mean a significant increase in the minimum wage. It is already expected that the minimum wage will rise to CZK 20,600 from next year (press release of the Ministry of Labour and Social Affairs available in Czech). The specific amount of the minimum monthly and hourly wage for the following year will always be decided by decree of the Ministry of Labour and Social Affairs by 30 September of the preceding year.

WHEN: Under this valorization mechanism, the minimum wage will be stipulated for the first time for the year 2025. From the date of effect of the amendment until the end of 2024, employees will be entitled to the minimum wage at the level in force before the amendment, i.e. at the level set by the Government in Government Decree No. 567/2006 Coll.

The guaranteed wage is abolished in the private sector altogether.

According to surveys, the vast majority of companies provide wages above the guaranteed wage levels. There are also often problems with correct job classification. The legislator has therefore decided to abolish the guaranteed wage in the private sector altogether. Protection against unreasonably low valuation of work will now be ensured by the minimum wage, which is expected to increase significantly.

The institution of guaranteed salaries in the public sector will remain effective. The lowest levels of guaranteed salary are set in four job groups according to a government regulation, instead of the previous eight.

WHEN: Under transitional provisions, employers will still have to respect the lowest guaranteed wage level for 2024 until the end of 2024.

The so-called self-scheduling of working hours by the employee is introduced. The employee and the employer will now be able to conclude a written agreement under which the employee will be able to schedule his or her own working hours. This will extend the possibility of self-scheduling from remote workers (as was possible before the amendment) to employees working at the workplace.

The length of a self-scheduled work shift must not exceed twelve hours and employees must observe the legal limits for daily and inter-shift rest and breaks. Since the employer is still responsible for compliance with these conditions, it is advisable that the employer continuously monitors compliance with them, for example by means of the employee’s timesheets (it is advisable to negotiate the obligation to keep such records with employees). It is also possible to negotiate other restrictions directly in the agreement, e.g. a prohibition to schedule working hours at night, on Saturdays and Sundays, on public holidays etc., in order to avoid the employer’s obligation to pay the corresponding premiums.

The agreement may also specify whether the employee is to have an even or uneven weekly working hours and how long the compensation period will be in such a case. It is necessary that the shifts scheduled correspond to the scope of the employee’s working hours and the compensation period (in the case of an uneven working hours schedule).

It may be preferable for the employer not to include the above limitations directly in the agreement, but to inform the employee of them in writing because of possible later changes. The agreement may be terminated by mutual agreement or by unilateral notice with 15-day notice period. Please note that this period already starts from the date of delivery of the notice to the other party.

This will also affect persons working under agreements for work performed outside the employment relationship, with whom an agreement may also be concluded. The employer would then be no longer obliged to schedule their working hours in advance, which was rather formal in practice anyway. However, it is advisable to negotiate a maximum number of working hours for a certain period with such workers (in particular to avoid exceeding the maximum limits of agreements for work performer outside the employment relationship). A fine of up to CZK 300,000 may be imposed under the Labour Inspection Act for failure to conclude a written agreement, for breach of obligations under the agreement or breach of the rules for terminating the agreement.

The new regulation on self-scheduling of working time will apply generally, both to the performance of work at the workplace and outside the workplace. It may be practical to enter into such agreements already within the framework of employment contracts or agreements for work performed outside the employment relationship (however, this does not affect the possibility of terminating said agreement).

WHEN: The effective date of this change is delayed until 1 January 2025.

Until now, the premium for work in difficult working environment in the public sector has been set at 5 % of the minimum wage, but the amendment sets a new amount ranging from 5% to 15% of the minimum wage. The final amount of the allowance will be determined by the employer within such specified range, considering the degree of risk, intensity and duration of the aggravating influences. The range will be determined annually for the following year by the Ministry of Labour and Social Affairs by 30 September.

WHEN: Under the transitional provisions, the increase in the premium will only apply from 1 January 2025.

Thanks to the amendment, it is now possible to negotiate remuneration from the agreement on work outside the employment relationship explicitly taking into account possible night work, work in a difficult working environment or work on Saturdays and Sundays. It is conditional upon agreeing on the scope of work in the given harder work regimes.

WHEN: 1 August 2024

The transposition amendment to the Labour Code in the Czech Republic abolishes the obligation for employers to issue a written annual leave schedule at the beginning of each calendar year. This step will reduce the administrative burden on the employer and better reflect the established practice, where it is quite common to proceed differently, and situations arise where the dates of annual leave are usually decided by the employees themselves during the calendar year and the employer only approves them.

However, it remains the case that the date of taking annual leave is ultimately determined by the employer according to its operational needs, while considering the legitimate interests of the employee.

WHEN: 1 August 2024

The transposition amendment to the Labour Code in the Czech Republic extends the regulation of collective bargaining and negotiations with trade unions. The amendment is intended to address situations in which several trade union organizations operating at an employer have disagreed on the content of a collective agreement and thus blocked its conclusion.

If the trade unions fail to reach an agreement within a certain period of time, the employer is entitled to conclude a collective agreement with the trade union organization with the largest number of members or with several union organizations with the largest collective number of members. This may be prevented only by written opposition of a majority of the employees.

WHEN: 1 August 2024

In the case of employees working in the healthcare sector in continuous operations, the possibility of scheduling a shift of up to 24 hours (from the normal 12 hours) is introduced. This is to avoid situations where healthcare workers are scheduled to work shifts with overtime. By definition, overtime cannot be scheduled in advance.

In connection with this, a new premium is also introduced for the increased workload of a healthcare worker of at least 20 % of average earnings for the 13th and each additional hour worked in such a shift.

In addition to the above, the obligation of employers to allow healthcare workers to improve their qualifications, which is considered to be the performance of work, and the right of healthcare workers to paid time off when increasing their qualifications are set (this change is regulated by Acts No. 95/2004 Coll. and No. 96/2004 Coll.).

WHEN: 1 August 2024

The transposition amendment to the Labour Code in the Czech Republic specifies the liability for wages of employees of subcontractors in the building industry. Specifically, the guarantee applies to the supply of the following: construction work provided during the execution of the construction, alteration or maintenance of the completed construction or during the removal of the construction on the construction site, in particular excavation work, earth moving, actual construction work, assembly and disassembly of prefabricated parts, installation of plant or equipment, construction modifications, construction renovation, construction repairs, construction disassembly, construction demolition, construction maintenance, painting and cleaning work as part of construction maintenance, construction remediation.

WHEN: 1 August 2024

Since the transposition amendment to the Labour Code in the Czech Republic was promulgated at the last possible moment in July and entered into force on the first day of the calendar month following its promulgation, it became effective as early as 1 August 2024, with the exception of the provisions on the distribution of working time and the amendments to the Labour Inspection Act, which enter into force on 1 January 2025. However, according to the transitional provisions, most of the substantive changes are also applicable only as of 1 January 2025, as mentioned above.

We will be happy to assist you with any obligations related to these changes, please do not hesitate to contact our team.

With effect from 1 July, there are changes in the area of labour law and the employment of foreigners resulting from the amendment to the Act on Social Security Contributions and the Employment Act. The changes regarding the agreements to complete a job (in Czech: “dohody o provedení práce”; “DPP”) have so far settled on the notification and record-keeping obligations of employers. As for the employment of foreigners, the adopted amendments have the potential to speed up and slightly simplify the procedure for obtaining the employment card.

Please find below the brief summary of the changes in employment law in the Czech Republic affecting employers as of 1 July 2024:

The effectiveness of the much discussed and somewhat controversial regulation of the aggregation of chained DPPs has been postponed to January 2025. Thus, there are no changes in regard to insurance premiums for the time being (i.e. no contributions to remuneration of up to CZK 10,000 for a single employer) and it is questionable whether and in what form they will eventually apply in 2025. We will of course monitor the situation.

However, as of this July employers must already comply with the newly regulated administrative obligations in relation to the DPPs, as follows:

From 1 July 2024, employers are required to keep records of all DPPs, regardless of whether they are subject to insurance premiums or not.

The records must contain information that is subsequently reported to the Czech Social Security Authority (”CSSA“) (see (Error! Reference source not found. below), i.e.:

Employers will be required to report a list of all employees employed on a DPP (insured and uninsured) on a monthly basis on the “DPP Statement” form.

The reporting obligation must be met electronically by the 20th of the following month, i.e. for the first time for July by 20 August 2024, to the locally competent SSA. The notification will apply to both DPPs concluded from 1 July 2024 onwards and DPPs concluded before 1 July 2024, if the DPP continues into July 2024

Non-registered employers who have so far employed employees only on DPPs which are not subject to insurance premiums must register with the Employer Registry by 30 July 2024. The SSA will assign them a variable symbol and they too will send their first DPP Statement by 20 August 2024.

Entry into and termination of employment of persons working under a DPP will also be reported through the DPP Statement. Therefore, DPPs subject to insurance premiums will no longer need to be separately notified via the “Notification of entry into or termination of employment”.

The statement will then be sent for each calendar month until the last employee on a agreement to complete a job has left the employment. When the decisive amount is reached (when the employee becomes insured), the employer also completes and files the Statement of Assessment and Premium Amount.

The purpose of the registration and reporting is to enable the authorities to collect the data needed to administer the new system of insurance of the DPP (as planned from next year), while the CSSA should also communicate the data found to the health insurance companies.

Relatively significant changes are also expected in the area of employment of foreigners as of 1 July 2024. In particular, the system for reporting the commencement and termination of employment of foreigners will change. And the establishment of free access to the labour market for employees from selected countries will help the labour market.

The Labour Office is introducing a new system of reporting the entry/termination of a foreign employee in employment by means of so-called notices and information cards, compulsorily from 1 July 2024. However, it is already possible to use the system at this time.

There will no longer be the option to complete using the paper forms previously used, but employers will be required to use one of the following methods:

For the information cards, only one form will be used from now on, through which employers will report both the entry and the departure of an alien employee. If, on joining, the employer also specifies a termination date (e.g. for fixed-term employment relationships) which will be met, there is no need to send an additional card.

Please note: The report must always be sent either by the direct employer or by a third party through a proxy report. If a third party sends the report instead of the employer (or an entity authorized by the employer), this third party would automatically be registered as the employer of the foreigner. Thus, the third party must first obtain authorization the CSSA system and then select the “file proxy” option for the submission or send the submission through their mailbox.

It is always possible to submit only one XML file per data message. If the employer has multiple reports (XML files), each must be sent separately.

A new reason for free access to the labour market has been added to Section 98(u) of the Employment Act for persons whose performance of work in the territory of the Czech Republic is in the interest of the Czech Republic.

This provides that, across the board, foreigners from certain countries will have free access to the labour market. The countries concerned will be determined by the government by regulation, currently the following countries:

The inclusion of Taiwan is envisaged in the future.

Please note that this is not a reciprocal regime, i.e. in the case of posting an employee to these countries from the Czech Republic, it is still necessary to verify whether a work permit is required in addition to a residence permit. These persons then still need some type of residence permit (e.g. a short-term visa; cannot be used for visa-free entry), but do not need any work permit.

Given the current labour market situation, the labour market test for employment cards will be “abolished” as of 1 July 2024. Employers will still have to notify the Labour Office of a vacancy for foreigners without free access to the labour market via a vacancy notification form. However, there will no longer be a labour market test.

Thus, foreigners will be able to apply for an employment card immediately after the vacancy has been published in the central register of vacancies to be filled by employment card holders. This will level the playing field with Blue Card applicants, who will not be subject to the labour market test from 1 July 2023.

The labour market test will not disappear completely, but it will no longer be automatic, however, it may be set in certain specific cases (e.g. in case of high unemployment or if the local regional branch of the Labour Office of the Czech Republic has enough suitable applicants or job seekers for a given job position). Especially in Prague, where the unemployment rate is very low, it can be expected that a labour market test will not be set.

In practice, this means that while the employer is obliged to report the vacancy, it will be able to do so just before the potential employee applies for an employment (blue) card.

The above changes will particularly affect employers who report vacancies to the Labour Office in advance as a precautionary measure, for which they have not yet found a foreign employee.

From 1 July 2024, the Labour Office will be able to remove a job from the vacancy register after 6 months from the date of its notification by the employer. This does not apply to a job for which there is a pending application for an employee card or blue card or a work permit for a foreigner, until the administrative proceedings are completed.

In addition, another – less obvious – reason for removing a job from the register has been introduced. This is the employer’s failure to provide cooperation. This rule was only inserted into the Act by amendment and is intended to allow for the removal from the register of those employers who are not at the specified contact address or otherwise reachable.

We can therefore only recommend that employers provide valid contact addresses in their reports and do not report vacancies too far in advance lest they expire in the meantime.

From 1 July 2024, new rules apply to the obligation to notify the posting of workers to the Czech Republic.

After 1 July 2024, it will no longer be possible to send notifications of the commencement of posting to the Czech Labour Office, such notifications will not be registered by the Czech Labour Office. Newly, foreign employers will have to notify the State Labour Inspection Office via the information system, according to the specifications, format and structure published by the State Labour Inspection Office.

More information can be found here.

We will be happy to help you with any obligations related to changes in employment law in the Czech Republic, please do not hesitate to contact our team.

With the arrival of entrepreneurs from Ukraine in the Czech Republic, the question arose as to whether these persons must have a trade license in the Czech Republic if they have a similar license in Ukraine and continue to provide their services remotely only to persons from Ukraine. These persons are staying in the Czech Republic under temporary protection and do not intend to offer their services in the country. They must also determine how to meet their tax and insurance obligations in the Czech Republic.

We have frequently encountered the issue of whether our clients need a trade license if they reside in the Czech Republic but do not intend to conduct business within the country.

These are typically persons with temporary protection who came to the Czech Republic due to the war in Ukraine but continue to work remotely for their clients in Ukraine. They have the appropriate Ukrainian business license for this activity.

Often, for example, these are IT specialists who simply do not need to offer their services here. All they need is their existing clients and remote work. Such a situation can be relevant also in the case of the so-called “nomads” who can stay in the Czech Republic for a longer period, but still provide remote services only to their country of origin.

Although these individuals do not offer their services to clients in the Czech Republic, they are still physically present in the country and conduct their business activities here. The assessment of this situation under Act No. 455/1991 Coll., on Trade Licensing (Trade Licensing Act) is not entirely clear. It is not clear from the Trade Licensing Act whether these persons must have a trade licence under the Trade Licensing Act or not.

According to Section 2 of the Trade Licensing Act, a trade is considered to be: “a continuous activity carried out independently, in one’s own name, on one’s own responsibility, for the purpose of making a profit and under the conditions set out in this Act.“

Section 5(5) of the Trade Licensing Act further states that: “a foreign natural person who intends to carry on a trade in the Czech Republic and who is obliged to have a permit for residence in the Czech Republic under a special law must submit a document proving the granting of a visa for a stay of over 90 days or a long-term residence permit to the registration of the trade and to the application for a concession.“

It follows from the above provisions that a trade licence will be required for a foreign person who:

From the definition, it is no longer clear what exactly is meant by the term “intends to carry on a trade in the territory of the Czech Republic“. The question is whether a person who resides in the Czech Republic but provides services exclusively to the country of origin according to local business rules, falls under the Trade Licensing Act, and thus the obligation to have a trade license. That is, a person who does not intend to do business here in the sense of offering their services in the territory.

With a request for an interpretation of the term “to carry on a trade in the territory of the Czech Republic” referred to in Section 5(5) of the Trade Licensing Act, we turned to the Ministry of Industry and Trade (MIT). The Ministry of Industry and Trade states that if a foreign national from a third country resides in the Czech Republic and continues their business activities connected only to their country of origin, they must still have a registered trade license under the Czech Trade Licensing Act. This applies also to entrepreneurs from Ukraine in the Czech Republic.

According to the MIT, such activity fulfils the characteristic of continuity. If a foreigner resides in the territory of the Czech Republic and carries out business activities to such an extent that the sign of systematic activity is met, he/she should have a trade license according to the Trade Licensing Act, pursuant to the statement of the Ministry of Industry and Trade.

From our point of view, this is a rather strict interpretation, as we see no reason why an activity that is performed by a foreign entity for foreign entities should be regulated by Czech legislation just because a foreign person with a computer is physically present in the Czech Republic. However, out of caution, we recommend applying for a trade license in the Czech Republic. The process is not very much complicated. If necessary, we will be happy to help you with it.

For those who, based on the above, decide to obtain a business license under the Trade Licensing Act, we provide a brief summary of the necessary requirements below.

If a foreign national from a third country resides in the Czech Republic (such as entrepreneurs from Ukraine in the Czech Republic), they can conduct business in the Czech Republic under similar conditions as citizens of the Czech Republic:

For third-country nationals, it is not necessary to have a special type of residence such as a long-term visa for business purposes in order to obtain a business license. They can also apply for a business permit with other forms of long-term residence, e.g. permanent residence or an employee card, while the original purpose of the stay, such as study or employment, must be observed. The key point is that the foreigner must have a long-term residence permit in the Czech Republic. This applies also to entrepreneurs from Ukraine in the Czech Republic

We recommend deciding in advance which fields of free trade you will carry out and report only these, rather than declaring all of them.

Generally, the criminal record must be issued by the country of which the foreign national is a citizen. The statement must not be older than 3 months. It must be duly certified and translated by an official translator. Verification generally means superlegalisation. If the country in question is a signatory to the Hague Convention, an apostille is sufficient. The Czech Republic has a bilateral agreement with some countries, which may stipulate that special verification is not necessary at all.

However, for persons under temporary protection, different rules apply to proof of good conduct than for other persons from third countries. Although some trade licensing offices may not be informed of this, persons with temporary protection do not have to provide an extract from the Ukrainian criminal record.

The reason for this is Section 32 of Act No. 221/2003 Coll., on the Temporary Protection of Foreign Nationals, according to which a foreigner enjoying temporary protection is considered to be – for the purposes of self-employment – a foreigner with a permanent residence permit under the Act on the Residence of Foreign Nationals in the Territory of the Czech Republic.

According to Section 6 (3) of the Trade Licensing Act, a clean criminal record is proven in the same way for persons with permanent residence in the Czech Republic as for citizens of the Czech Republic. In the case of citizens of the Czech Republic, a clean criminal record is proven only by an extract from the Czech Criminal Register. The Trade Licensing Office is entitled to request an extract from the Czech Criminal Register itself.

It follows from the above that persons with temporary protection should not be forced to submit an extract from the criminal record from their country of origin to trade licensing offices.

Finally, we would like to emphasize the connection between the foreigner’s residence and their business in the Czech Republic. As far as residency is concerned, a business can serve as one of the purposes for which a long-term residence permit or visa is issued. Foreigners typically first apply for a long-term visa for the purpose of doing business at an embassy. This visa is issued for a maximum period of one year. Before its end, foreigners can apply for a long-term residence permit in the Czech Republic for the same purpose.

In general, however, obtaining long-term visas for business purposes is problematic, not only for entrepreneurs from Ukraine in the Czech Republic. It requires careful documentation of the purpose of stay, and embassies often set quotas for the number of applications received per year, which can make it impossible in practice to submit the application itself.

The extent of the tax liability affects tax residency of entrepreneurs from Ukraine in the Czech Republic. A tax resident taxes his/her worldwide income in the relevant country (or applies a method of avoiding double taxation), a tax non-resident only income from sources in the given country. In any case, an activity performed physically from the Czech Republic on the basis of a trade license is considered to be income from self-employment taxable and insurable in the Czech Republic. As part of the process of obtaining a trade license, it is also possible to make the relevant registrations/notifications of the commencement of business activities to the relevant institutions.

Income from self-employment is then taxed on an annual basis through personal income tax returns and insurance statements. Alternatively, the taxpayer can opt for a flat-rate tax regime. If the business is the main source of income for the payer, it is obliged to pay advances on insurance premiums in the minimum amount from the start of the business.ce on the matter and do not represent a customized professional advice. Furthermore, because the legislation is changing continuo

The issue of persons with temporary protection, such as entrepreneurs from Ukraine in the Czech Republic doing business remotely to the country of origin raises questions about the need for a Czech trade license. The interpretation of the Ministry of Industry and Trade implies a strict statement on the requirement of a trade licence for business activities carried out in the Czech Republic, even if they are focused exclusively on the foreigner’s country of origin. This is also associated with the obligation to register and pay taxes and insurance premiums in the Czech Republic.

We recommend that entrepreneurs from Ukraine in the Czech Republic, not only with temporary protection, who continue to conduct business remotely with their country of origin, consider obtaining a trade license in the Czech Republic. If necessary, we are happy to assist you with analysing your situation, arranging a trade license, and settling tax and insurance obligations.