Get free access to

Our legislation updates make it easy for you to keep on top of the latest changes affecting your business. Receive our articles, opinions, tips, industry news, country profiles, regional overviews and studies, latest events and even more, directly into your mailbox.

Check out our Newsroom to see what is included!

We will send you only relevant information we consider may be of your interest and treat your personal data in compliance with our Privacy policy and GDPR statement.

Unable to subscribe? Try this page.

When it comes to employee compensation, the gross salary specified in an employment contract is a critical element. However, understanding the difference between the gross and net amount actually received is equally important for both employees and employers – what a company states as the gross amount is not what employee receives as their net pay. For businesses, it is necessary to understand the complexities of gross salary and its components to ensure compliance and transparency in payroll processes.

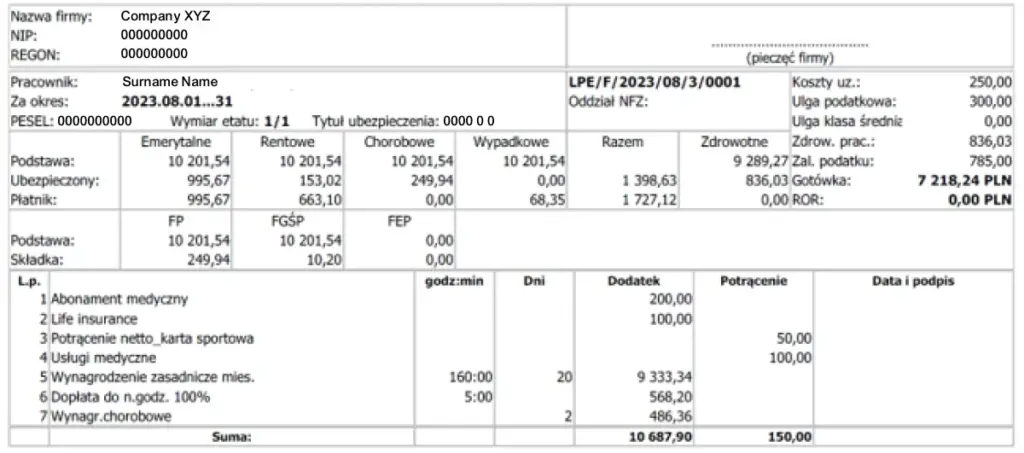

In case you are interested in a more detailed overview of the Polish payslip details, you may want to check out our comprehensive payslip reading guide, available also for free download.

The gross salary represents the remuneration stated in the employment contract. It is the amount from which various deductions are made, resulting in the net pay that an employee takes home. These deductions include social security contributions (e.g. pension, disability, sickness insurance), healthcare contribution and income tax advance. Thus, the amount received by the employee is in fact lower.

The formula to calculate net pay is as follows:

NET PAY = GROSS AMOUNT– SOCIAL SECURITY CONTRIBUTIONS– HEALTHCARE CONTRIBUTION – INCOME TAX ADVANCE

To ensure transparency and fair compensation, employers and employees need to know what components gross salary is made up of. It consists of various elements, including:

With the exception of allowances, all of these components are subject to both ZUS contributions (sick pay – healthcare only) and taxation. Some components, however, may be exempt from ZUS contributions, like the employer’s PPE contribution and certain benefits in kind granted during maternity/parental leave, which are only subject to taxation.

Social security contributions play a significant role in determining an employee’s net pay. They are categorised into several types, each with its own rates and distribution between the employee and the employer. The types of contributions and their rates are as follows:

| Type of contribution | Employee’s contributions | Employer’s contributions | Contribution rate |

| Pension contribution | 9,76% | 9,76% | 19,52% |

| Disability contribution | 1,5% | 6,5% | 8,00% |

| Sickness contribution | 2,45% | – | 2,45% |

| Accident contribution | – | 0,67% | 0,67% |

| Labour Fund and Fund of Guaranteed Employee Benefits | – | 1,10% | 1,10% |

| SUM | 13,71% | 18,03% |

The healthcare contribution is based on the gross salary minus social security contributions (13.71%). It is calculated at 9% of this base. Additionally, the income tax advance is computed using formula that considers the gross salary, social security contributions and tax-deductible costs. The tax thresholds, which determine the tax rate, are essential aspects of this calculation:

Income tax advance = (Gross salary – social security contributions – Tax-deductible costs 250 PLN or 300 PLN) x 12% or 32%* – tax-free amount (300 PLN/month)

*Tax thresholds rates are:

Benefits in kind refer to non-monetary components of the salary, such as medical care packages, sports cards, or life insurance premiums, provided by the employer. These components are subject to social security contributions and taxation. On the other hand, voluntary deductions are not a subject to social contributions and tax and made from the net pay, typically including additional medical care packages, higher-than-standard value for sports cards and an additional deduction for PPE.

The payslip is an important document that provides a comprehensive overview of the employee’s earnings and the various deductions made to arrive at the net pay. Here are the key components for better understanding the compensation details:

Understanding the nuances of gross salary, social security contributions, healthcare contribution, income tax advance, benefits in kind, and voluntary deductions is critical for companies. By considering these aspects, companies can effectively manage their payroll processes, ensure compliance with tax and social security regulations, and maintain transparent and fair compensation practices for their employees.

On 12 April 2019 polish parliament passed a law introducing changes in tax provisions. The most important changes are concerned with establishing a new VAT taxpayer register, the so called whitelist of VAT taxpayers in Poland.

One of the most important tax changes, that entrepreneurs running a business in Poland will face soon, are new rules on withholding tax (WHT). Changes proposed by the Ministry of Finance refer primarily to entities making cross-border payments, but also national payments of dividends and participation in profits of legal persons.

The general principle resulting from the amendment is the obligation of the entities making the payment, to collect from these payments and pay tax. In this case, the role of the tax remitter is particularly important.

Tax remitter is an entity obliged to calculate, collect and pay the tax in a proper amount, and in case of not fulfilling these obligations, may be responsible for the arrears arisen and bear penal and fiscal responsibility.

According to the new withholding tax obligations, tax remitters (either Polish companies or individuals) will be required to collect the withholding tax in full amount (from the amount exceeding PLN 2 million) at standard rates (usually 20% or 19%). If exemption or diminished tax rate may be used tax remitter or taxpayer may apply for a refund.

Examples of transactions affected by the new regulations:

To apply the exemption or preferential tax rate, a statement needs to be submitted to the tax authorities, confirming that the tax remitter is in possession of appropriate documents and as a result of verification, there is no grounds to question the possibility of applying preferences. The statement needs to be signed by the whole management board. After submitting such statement on the day of payment at latest, exemptions or preferential taxation rates may be applied for two months, after this period it is necessary to submit the statement again.

Our Accace tax team has developed a procedure for such verification and prepared a checklist, which is the basis for submitting a statement to the tax authorities. The Accace tax team will be happy to help with the implementation of such verification procedures.