Get free access to

Our legislation updates make it easy for you to keep on top of the latest changes affecting your business. Receive our articles, opinions, tips, industry news, country profiles, regional overviews and studies, latest events and even more, directly into your mailbox.

Check out our Newsroom to see what is included!

We will send you only relevant information we consider may be of your interest and treat your personal data in compliance with our Privacy policy and GDPR statement.

Unable to subscribe? Try this page.

Accounting in Slovakia comes with its own set of unique challenges and opportunities. From strict compliance regulations and VAT requirements to tailored financial reporting standards, navigating this framework requires clarity and precision. Whether you’re a local entrepreneur or an international business, staying on top of these requirements is essential for maintaining compliance and driving success.

Dive into the details to ensure your financial operations are not just compliant but optimized for success in Slovakia’s rapidly modernizing environment.

In this article, you’ll learn about:

In our practice, we observe that foreign clients are often surprised by the stringent regulations imposed in Slovakia, even for small entities. Our accountants are required to meticulously document all transactions, including food purchases. Additionally, VAT compliance is quite rigorous, as there is no option to defer VAT output. Consequently, many supplementary VAT returns are often necessary.

Since 2022, digitalization has been a major focus in the Slovak Republic. Companies are encouraged to archive accounting documents electronically, with internal regulations guiding the process. They may choose any tool for this purpose.

A new financial transaction tax will be implemented on April 1, 2025. This tax applies to outgoing payments at a rate of 0.4%.

The primary legislative act governing accounting in Slovakia is 431/2002 Coll. Act on Accounting.

Slovak Accounting Standards (SAS) are rule-based, while IFRS is principle-based. IFRS uses real values, whereas SAS relies on accounting values without reflecting increases, except for a limited list of short-term financial assets.

IFRS is mandatory for certain entities such as banks, insurance companies, and large companies after they exceed a specific size threshold. It is also required for payment institutions, securities issuers, and in some special cases, such as legal successors.

The chart of accounts is defined at the level of synthetic accounts. Companies develop their own charts of accounts with analytical accounts based on the prescribed chart of accounts. It is not permissible to use alternative accounts for statutory purposes; alternative accounts may only be utilized for reporting purposes within internal accounting, as provided by the accounting group.

Financial statements are specified according to regulations. Entities are classified into three categories—micro, small, and big—based on their size limits. There are different requirements for the financial statements of each type of entity.

Companies must audit their accounts if they exceed 2 of these criteria:

The legal framework for archiving accounting documents is relatively strict. The periods vary from 5 to 10 years, based on the type of the accounting documents. The legal framework provides guidance not only on archiving but also on the ways of disposing of the documents.

A popular alternative to old-fashioned archives of documents in hard copies is digitalization. Electronic archiving is possible if the company can prove the genuine origin of the documents, inviolability, and legibility. This modern approach is transforming accounting.

VAT registration is mandatory for companies with a turnover more than 50 000 EUR, but there is also a possibility for voluntary registration. When a company is a monthly VAT payer, the deadline for the submission of VAT return, OSS return, control list and EU sales list is the 25th of the following months and it is also due date for VAT payment. All communication, requests and submissions are made electronically in Slovak language, but through power of attorney it could be delegated to other person. To find out more about the local VAT system, check out our dedicated guide on value-added tax in Slovakia.

Starting in 2025, Slovakia’s corporate income tax rates are:

The deadline for CIT is March 31 of following year, but it can be postponed by 3 months for all taxpayers and 6 months if the taxpayer has also income from foreign countries.

Just like for VAT, everything is filled only electronically on the prescribed return form.

To find out more about the local tax system, check out our dedicated tax guideline for Slovakia.

IFRS and IAS are international financial reporting standards which companies must follow when preparing and disclosing their financial statements. International Accounting Standards Board (IASB) published several new changes and amendments to IAS1, IAS8, IAS12 a IFRS 17.

Hereby, we bring you a summary of the most significant changes valid from January 1, 2023.

New amendments have been issued relating to disclosures in financial standards.

The aim is to aid with decision as to which accounting policies to disclose in financial standards in order to provide more useful information to the users of the standards.The aim is to aid with decision as to which accounting policies to disclose in financial standards in order to provide more useful information to the users of financial standards.Companies are required to disclose information regarding the material accounting policies as opposed to the significant accounting policies. Additionally, guidance has been provided on applying the concept of materiality when deciding on accounting policy disclosures (IFRS Practice Statement 2 includes specific examples).Companies should review or amend their accounting policy disclosures to ensure the consistency with the updated standard.

The Board also issued amendments to IAS 8 to help with distinguishing between changes in accounting policies and changes in accounting estimates.A new definition on accounting estimates was introduced, where accounting estimates are “monetary amounts in FS that are subject to measurement uncertainty “. A change in accounting estimate resulting from new information/developments is not classed as the correction of an error. The effects of a change in an input/measurement technique are changes in accounting estimates if they do not result from the correction of prior period errors.Changes in accounting estimates are applied prospectively only to current or future transactions and other future events.

The aim is to provide clarification on how to account for deferred tax on transaction such as leases. This should reduce the diversity in accounting.Amendments include an additional condition where the exemption for the initial recognition does not apply. A temporary difference arising on initial recognition of an asset/liability is not subject to initial exemption if the transaction gave rise to equal taxable and deductible temporary differences.Companies with significant balances of right-of-use assets, lease liabilities, decommissioning liabilities, etc. are highly affected as the additional deferred tax will have to recognised in financial standards.

The new standard replaces IFRS 4.It applies to all types of insurance contracts regardless of what type of company issues them.The aim is to help companies with the implementation of the standard. It should increase transparency and reduce diversity in the accounting.Not sure if these obligations apply to your business? Read more about who must prepare financial statements in accordance with IFRS in our article.

In the field of accounting, there are two financial reporting standards – International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (US GAAP).

Convergence between IFRS and US GAAP is one of the bigger issues in the global implementation of IFRS. At present, all US entities have to file accounts prepared under local US GAAP except for the overseas issuer of securities, they have option of using IFRS from 2010.

IFRS is the most commonly used system in the world, and this method of accounting for publicly traded companies is used by more than 100 countries.

FASB and IASB continues work collaboratively in adoption of new standards. But do you know the difference between them? We have compiled a clear table of basic differences between IFRS and US GAAP for you, which will help you with that.

| IFRS | US GAAP | |

| Comparative information | Statement of financial position is required for the previous period for all amounts reported in the financial statements | Statement of financial position requires comparatives for 2 most recent years |

| Value in use | Discounted cash flow | Undiscounted cash flow |

| Cash flow statements | Bank overdrafts are included in cash and cash equivalents | Bank overdrafts are treated as part of financing |

| Extraordinary items | For IFRS they are prohibited | For US GAAP they are not used anymore |

| Revaluation | May be applied | Prohibited |

| Development costs | Capitalisation as assets | Costs in period when occurred |

| Component depreciation | Required if components having different patterns of benefit | Permitted but not common |

| Borrowing costs – interests | Can include more components | Exchange rates are excluded |

At Accace, we focus mainly on accounting according to IFRS, and we also covered the topic in our latest IFRS News Flash. However, it can be challenging to become familiar with this topic, so our experts in International Financial Reporting Standards are ready to give you an advice.

The Exposure Draft ED/2019/7 includes the proposals of the International Accounting Standards Board (Board) to improve how information is communicated in the financial statements, with a focus on information about performance of the statement of profit or loss. The Board is proposing following limited changes in general IAS presentation and disclosures, affecting the statement of cash flows and the statement of financial position.

The Exposure Draft that brings changes in general IAS presentation and disclosures includes:

The Exposure Draft proposes that an entity presents the following new subtotals in the statement of profit or loss:

The Board proposes to define ‘integral associates and joint ventures’ and ‘non-integral associates and joint ventures’, and to require an entity to classify its equity-accounted associates and joint ventures as either integral or non-integral to the entity’s main business activities.

The Board also proposes to require an entity to provide information about integral associates and joint ventures separately from that for non-integral associates and joint ventures.

The Board proposes that an entity would be required to:

The Board does not propose to define earnings before interest, tax, depreciation and amortization (EBITDA) in this project.

The Board considered it, but rejected, describing operating profit or loss before depreciation and amortization as EBITDA.

However, the Board proposes to exempt from the disclosure requirements for management performance measures a subtotal calculated as operating profit or loss before depreciation and amortization.

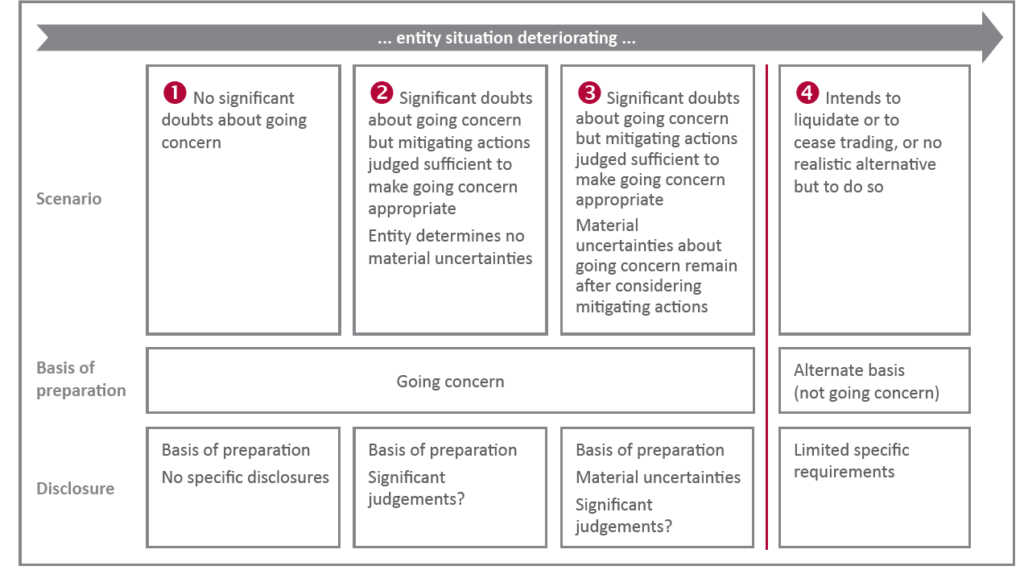

IFRS Foundation published educational material to support companies in applying going concern requirements. In current pandemic, many entities face falling revenues and decline in their profitability and liquidity which raise the question about their ability to continue as going concern. Therefore, management needs to involve a greater deal of judgement as in preceding period that should be disclosed. Those disclosures are likely to be more relevant for users of financial statements, too.

IAS 1 stands that “An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no realistic alternative but to do so.“ Assessment is made for 12 months at least and includes:

Entity should also disclose any change in ability to continue as going concern in accordance with IAS 10 Events after the Reporting Period. If, before the financial statements are authorised for issue, circumstances were to deteriorate so that management no longer has any realistic alternative but to cease trading, the financial statements must not be prepared on a going concern basis.

Possible situations when applying the requirements

The requirements in IAS 1 can be depicted as set out in diagram below*:

*IFRS Foundation – Going concern – a focus on disclosures, January 2021

Coronavirus has brought a number of unexpected changes to our lives. Many of these changes have an impact on entrepreneurship, economy or the accounting itself. Our experts prepared a list of the most significant changes in accounting that the coronavirus entails.

Financial statements should be prepared on a going concern basis, unless management intends either to liquidate the entity or to cease trading or has no realistic alternative but to do so.

Management is required to assess at the time of preparing the financial statements the entity`s ability cover the entity’s prospects for at least 12 months from the end of the accounting period.

Existence of significant doubts shall be disclosed but it is not sufficient reason for the preparation of the financial statements on a going concern basis. Disclosed uncertainty about the future prospects of the entity should contain depiction of circumstances (degree of consideration and conclusion reached) and significant judgements made.

The entity needs to assess if the sale of the financial instruments is in the line with the entity`s documented investment policy. If the sale is due to increased credit risk, it could be still consistent with hold-to-collect business model.

Entity should also assess if the expected credit loss model is correctly presented due to pandemic the liquidity problems could rise what could influence the credit quality of financial instruments.

This assessment will require significant judgement, update of macroeconomics scenarios. The disclosure of these judgements, estimates and key assumptions are going to be more important.

The entities are required to provide the impairments test of non-financial assets when the indicators of value deterioration exist. Due to pandemic the external indicator influence all the entities and they need to be prepared to perform the significant impairment testing and measure the value in use and fair value of non-financial assets.

Entities should consider providing detailed disclosures on the assumptions and sensitivities.

Accordingly, entities should analyse all facts and circumstances carefully to apply the appropriate relevant accounting standards:

Any tax relief or rebates received by the government need to be carefully assessed in order to determine whether they should be accounted for as a reduction to the income tax expense, or the receipt of a government grant.

Uncertainties relating to income taxes arising from these new government measures will require entities to consider whether they should recognise and measure deferred tax assets or liabilities at a different amount.

If there has been a change in the lease, entity need to assess whether the changes are in the line with the original terms and conditions of the lease. Otherwise the entity should account for lease modification.

On 28 May 2020, the IASB issued Covid-19-Related Rent Concessions -Amendment to IFRS 16 Leases (the amendment) for lessee.

A lessee applies the amendment for annual reporting periods beginning on or after 1 June 2020.

The Board amended the standard to provide optional relief to lessees from applying IFRS 16 guidance on lease modification accounting for rent concessions arising as a direct consequence of the coronavirus pandemic. The lessee could the rent concessions account directly to income statement.

The unavoidable costs under an onerous contract reflects the least net cost of exiting from the contract, which is the lower of the cost of fulfilling it and any compensation or penalties arising from failure to fulfil it.

In assessing the unavoidable costs of meeting the obligations under a contract at the reporting date, entities, especially those with non-standardised contract terms, need to carefully identify and quantify any compensation or penalties arising from failure to fulfil it.

Entity need to consider impact of the modification and termination of contracts, other variable consideration and customer incentives following the collectability.

Reduced demand may lead entities to write-down their inventories to net realisable value and determining net realisable value may require the use of significant judgement and additional disclosures are necessary.

Entities need to ensure effective processes are in place to identify and disclose material events (both adjusting and non-adjusting) after the reporting period which could reasonably be expected to influence decisions that the primary users of general-purpose financial statements make on the basis of those financial statements.

IFRS 16 leases replace IAS 17 leases, for reporting periods beginning on or after 1 January 2019 and will end the practice of significant leased property assets being ‘off balance sheet’. Therefore, many companies are yet to adopt it. Find out with us the answers to the most frequently asked questions related to planned changes below.

IFRS 16 defines a lease on the basis of whether a customer controls the use of an identified asset for a period of time, which may be determined by a defined amount of use. If the customer controls the use of an identified asset for a period of time, then the contract contains a lease.

In contrast, in a service contract, the supplier controls the use of any assets used to deliver the service.

The major change is that under IFRS 16 there will no longer be any distinction between operating and finance leases in the financial statements of lessees. This means that entities will be required to include a right-of-use asset and an equivalent liability, at the present value of lease payments to their financial statements.

IFRS 16 permits a lessee to elect not to apply the recognition requirements to short-term leases. Instead, a lessee can recognise the lease payments associated with short-term lease (maximum possible term of 12 months or less) is as an expense over the lease term, typically on a straight-line basis.

IFRS 16 also permits a lessee to elect, on a lease-by-lease basis, not to apply the recognition requirements of IFRS 16 to leases for which the underlying asset is of low value (USD 5,000 or less).

The proposed lease changes will have a significant impact on many of the key financial statement ratio calculations used in assessing the performance or position of an entity. The gearing or leverage ratios will increase, as there will be additional liabilities brought into the debt element of the calculation. EBITDA (earnings before interest, tax, depreciation and amortisation) figures are likely to rise for companies applying IFRS 16 and the calculation return on capital employed will reduce.

Retailers will be affected in an extensive amount, as the retail sector’s fixed asset base is largely leased, often on longer-term, non-cancellable leases.

Will Your Company apply the new standard IFRS 16? Let’s implement the changes together. Contact us!