Get free access to

Our legislation updates make it easy for you to keep on top of the latest changes affecting your business. Receive our articles, opinions, tips, industry news, country profiles, regional overviews and studies, latest events and even more, directly into your mailbox.

Check out our Newsroom to see what is included!

We will send you only relevant information we consider may be of your interest and treat your personal data in compliance with our Privacy policy and GDPR statement.

Unable to subscribe? Try this page.

Planning to start a business in Slovakia? Discover the 10 key facts about the Slovak tax system that are crucial for any entity – new or already established. For a more complex overview, we recommend to take a look on our Tax guideline for 2024.

15% is the corporate income tax rate for taxpayers with taxable income not exceeding EUR 100,000 per tax period

Tax on insurance

Tax on financial transactions

Top-up tax

Tax on sweetened non-alcoholic beverages

10% – Applies to dividends paid out from profits reported for the tax period 2024 by domestic companies to individual shareholders.

7% – Applies to dividends from profits derived between years 2017 – 2023 and periods beginning no earlier than January 1, 2025 by domestic companies to individual shareholders.

Tax losses can be carried forward for up to 5 subsequent years, up to a maximum of 50% of the reported tax base. However, taxpayers who qualify as micro-taxpayers may apply tax losses up to 100% of the reported tax base.

23%

0% – On the export of goods and services, and intra-community supplies of goods under some conditions

19% – First reduced VAT rate applicable to a limited range of goods and services

5% – Second reduced VAT rate applicable to a limited range of goods and services

0.25% of the value – General land tax

EUR 0.033/m2 – Tax on building and apartment

These rates may be modified according to local conditions

19% – 25% is the standard rate

Income from business: 19% – 25% for taxpayers with taxable income exceeding EUR 100,000 per tax period

15% is the tax rate in other cases

13.4%

36.2%

Cross-border employment brings a new set of responsibilities when it comes to fiscal obligations. Our overview on global mobility and expat tax in the Czech Republic, prepared by our local tax experts, provides you a comprehensive overview on tax residency conditions, personal income tax, social security and health insurance contributions or penalties for non-compliance.

Our local tax, payroll and labour law experts are here to help you – as an expat or an employer – to obtain essential professional advice, so that you can effectively address all the matters related to cross-border mobility in the Czech Republic and other locations globally.

An individual is considered a Czech tax resident if:

The individual has a permanent place of residence in the Czech Republic in which they intend to stay permanently

The individual stays for 183 days or more in the Czech Republic continuously or intermittently in the calendar year

Based on the Czech legislation, the following types of income are subject to taxation:

Employment income: Salaries, bonuses, remuneration of executives and members of the board of directors.

Self-employment income: Revenues from business and professional services.

Capital gains: Interests and dividends (from foreign sources), dividends and interests from Czech sources are usually subject to withholding tax at source and may not be included in the annual personal income tax return.

Rental income: Proceeds from the lease of real estate and flats, long-term rental of movables.

Other income: Proceeds from the sale of securities, sale of property (unless they are exempt from taxation).

A specific group of income from dependent activities are employee benefits, such as:

Pension and life insurance contributions: exempt from tax up to CZK 50,000 / year.

Contributions to retirement savings products – exempt from tax up to CZK 50,000 / year. The retirement savings products are defined by the Czech tax legislation as:

Non-monetary benefits in the field of culture, education, purchase of services and goods from medical institutions, recreation and trips etc., which are provided by the employer to the employee or his/her family members, are exempt from taxation on the employee’s part only up to half of the average wage for the whole calendar year. For 2025, the threshold is CZK 23,278. The employee’s taxable income is the amount exceeding the limit. The tax non-deductibility on the employer’s part is linked to the exemption on the employee’s part i.e. expenditure on non-monetary benefits is always tax non-deductible if it is also exempt on the employee’s part. Excess amounts might be tax deductible on the employer’s part if the entitlement to non-monetary benefits is based on an internal regulation, collective agreement or employment contract.

Meal vouchers, employer canteen and meal cash allowance: exempt up to 70% of the upper limit of the meal allowance that can be granted to employees for a business trip lasting 5 to 12 hours (for 2025 the amount is CZK 123.90). For exemption from taxation, it is also necessary to meet the condition of the employee’s presence at work which lasts at least 3 hours. For shifts lasting at least 11 hours, it will be possible to grant double the amount. The amount above the stipulated limit is considered employee’s taxable income subject to social security and health insurance contributions (both on the employee’s and the employer’s side). The claim should be stipulated in an internal directive/employment contract.

Calendar year

If an employer employs an EU citizen, they have the following information obligation:

Must electronically inform the Labour Office of the Czech Republic about the start of employment of an EU citizen or their family member.

This obligation must be fulfilled by the employer no later than the first day of employment. The notification can be submitted via an electronic information card or by sending an XML file via a data box, or by direct integration into the Ministry of Labour and Social Affairs (API) interface.

In the event of termination of employment or changes in data, the employer is obliged to inform the Labour Office of the Czech Republic within 10 calendar days at the latest.

If the employment contract is for an indefinite period, termination must be reported. If it is for a fixed term and the employee terminates in accordance with the reported period of employment, notification of termination is not required.

The employer is also obliged to keep records of all foreigners employed.

The employer faces a fine of up to CZK 100,000 for non-compliance with the information or registration obligation.

As with the employment of EU citizens, employers have almost the same obligations:

Must electronically inform the Labour Office of the Czech Republic in writing about the start of employment.

This obligation must be fulfilled by the employer no later than the first day of employment. The notification can be submitted via an electronic communication or by sending an XML file via a data box, or by direct integration into the Ministry of Labour and Social Affairs (API) interface.

In the event of termination of employment or changes in data, the employer is obliged to inform the Labour Office of the Czech Republic within 10 calendar days at the latest.

If the employment contract is for an indefinite period, termination must be reported. If it is for a fixed term and the employee terminates in accordance with the reported period of employment, notification of termination is not required.

The employer is also obliged to keep records of all foreigners employed.

The employer faces a fine of up to CZK 100,000 for non-compliance with the information and registration obligation.

Furthermore, the employer is obliged to keep copies of documents proving the right of residence of foreigners, for the duration of employment and for a period of 3 years from termination.

The tax return is due 3 months after the end of the tax period. More precisely, the deadline is the following:

April 1, if submitted in paper form

May 1, if submitted electronically via data mailbox

July 1, if the tax return is filed by a tax advisor based on a power of attorney

Deadline extension by further 3 months, or until November 1 in case there is a foreign income

Delayed filing of the tax return: 0.05 % of tax assessed, 0.01 % of tax loss, max. 5% or CZK 300,000.

Delayed payment of the due tax: the CNB’s annual repo rate at the first day of the relevant calendar half-year increased by 8%

Delayed or missing registrations at tax authorities: up to CZK 500,000

Delayed or missing report on monthly salary or withholding tax from salary: up to CZK 500,000

Not requesting an A1 form from the respective authorities: up to CZK 20,000

Delayed report on social security: up to CZK 50,000

Delayed payment of the social security contributions: Late interest payment calculated on the CNB’s annual repo rate at the first day of the relevant calendar half-year increased by 8%. The late interest payment is issued only if exceeds CZK 1,000.

Delayed or missing registrations for the purposes of social security: up to CZK 20,000

Delayed report on health insurance: up to CZK 50,000

Delayed payment of the health insurance contributions: Late interest payment calculated on the CNB’s annual repo rate at the first day of the relevant calendar half-year increased by 8%. The late interest payment is issued only if exceeds CZK 1,000.

Delayed or missing registrations for the purposes of health insurance: up to CZK 10,000 or CZK 20,000 in case of repeated failure

The One Stop Shop or OSS in Poland procedure is an electronic one-stop shop for simplifying the settlement of output VAT on sales of goods and services to consumers from other EU countries, i.e. individuals who do not conduct business activities.

The premise of the OSS procedure in Poland is to enable settlement of VAT on the above transactions with the tax administration in one EU Member State. The taxpayer submits to one tax administration information on his sales of goods and services to individuals from other EU countries and pays the VAT. Based on the declarations submitted, the tax administration distributes and remits the appropriate part of the VAT paid in the country of identification to the relevant EU country of consumption.

The OSS procedure reduces the taxpayer’s obligations to register and settle VAT in different EU countries. Without OSS procedures, a supplier would generally be required to register in each Member State in which he sells goods or services to individuals.

There are two procedures available under the OSS procedure: the EU procedure and the non-EU procedure.

The EU procedure can be used, among others, by taxpayers established in the EU who:

Registration for the OSS procedure is made in a single Member State, the so-called Member State of Identification. In principle, the Member State of Identification is the Member State in which the taxpayer has its seat of economic activity.

The tax authority competent for the OSS procedure in Poland is the Head of the Second Tax Office Warsaw-Downtown.

To register for the OSS procedure, the following documents should be submitted:

Registration for the OSS procedure will be effective for taxpayer from the first day of the calendar quarter following the quarter in which the VIU-R form was submitted.

Once registration to the OSS procedure is done, then VAT must be declared and settled on all supplies of goods or services covered by this procedure.

This means that after registration via the OSS procedure, output VAT will have to be reported on supplies of goods to individuals from other EU countries. It regards also supplies of below services to individuals from other EU countries:

Once the OSS procedure has been notified, additional records of transactions covered by this procedure should be kept. These records are in electronic form and shall be kept for a period of 10 years from the end of the year in which the transaction took place.

These records should include the following data:

It should be emphasised that entities notified to the OSS are obliged to provide their records in electronic form whenever requested by the tax administration of both the Member State of identification and consumption.

A taxpayer registered for the OSS procedure in Poland is required to submit via the e-Declaration system: VAT returns (VIU-DO).

The return shall be submitted on a quarterly basis by the end of the month following each consecutive quarter.

The table below shows the deadlines for submitting VAT returns (VIU-DO).

| Settlement period – calendar quarter | Date of submission of return for OSS |

| Q1: 1 January do 31 March | 30 April |

| Q2: 1 April do 30 June | 31 July |

| Q3: 1 July do 30 September | 31 October |

| Q4: 1 October do 31 December | 31 January (next year) |

Amounts on the VAT return shall be expressed in euro and shall not be rounded up or down.

The VAT return for the OSS is supplementary and does not replace the VAT return that the taxpayer submits in his Member State as part of his domestic VAT obligations.

This means that after registering for the OSS procedure, taxpayer will be obliged to submit, as before, JPK_VAT files (in which should be reported, for example, retail sales in Poland and distance sales from warehouses in Poland to Polish buyers), and in addition will submit VAT returns (VIU-DO) by the end of the month following each subsequent quarter.

A taxpayer using the OSS procedure shall submit a VAT return for each calendar quarter, irrespective of whether the supply of goods or services covered by the procedure has taken place.

This means that if there are no activities covered by the OSS procedure and no adjustments have been made relating to previous returns of the settlement period, a nil VAT return (VIU-DO) shall be submitted.

It should be underlined that the VAT return (VIU-DO) cannot be submitted before the end of the settlement period.

The deadline for submitting the return also expires if that day falls on a Saturday or a public holiday.

Where mistakes are found in the VAT return (VIU-DO) submitted, the adjustment shall be made in the return submitted for the current tax period, but no later than 3 years after the expiry of the deadline for submission of the VAT return in which the mistakes were found.

The VAT return (VIU-DO) in which the correction is made shall indicate the Member State of consumption concerned, the tax period and the amount of VAT in respect of which the correction is made.

Nevertheless in the case of:

– an adjustment of the VAT return (VIU-DO) shall be submitted electronically via a special IT application to the Łódź Tax Office.

Payment of the VAT amount in respect of which the adjustment is made should be done in euro to the bank account of the Łódź Tax Office.

Once the VAT return (VIU-DO) has been submitted, it will be assigned a unique reference number (UNR).

The reference number (UNR) of the VAT return must always be indicated when making a payment. Without a reference number, it is not possible to make an effective payment and you should expect that such a payment will not be recognised and will be returned to the payer’s account.

The unique reference number for the EU procedure consists of the code of the Member State of identification, the VAT number and the period (quarter/year) for which the return is submitted.

An example of a UNR number for an EU OSS procedure is – PL/PLXXXXXXX/Q3.2023

The deadline for payment of VAT is the last day of the month following each consecutive quarter.

The deadline for submitting the return also expires if that day falls on a Saturday or a public holiday.

VAT resulting from the VAT return (VIU-DO) shall be paid in euro to the following bank account of the Second Tax Office Warsaw-Śródmieście:

The distribution of payments between the Member States of consumption is carried out by the tax authority on behalf of the taxpayer.

The Taxpayer intends to apply for the OSS procedure and report in its VAT return (VIU-DO) the distance selling of goods to individuals from various EU countries.

To correctly complete the return for the above transactions, it is necessary:

In addition in section C.5. adjustments to the VAT amounts indicated in the returns for previous periods resulting from corrections to supplies of goods or services (no later than 3 years after the deadline for submission of the original return) should be reported.

In section C.6. the balance of output tax should be reported for each Member State of consumption. This position is filled in automatically and is the sum of the VAT amounts from Sections C.2, C.3, C.4 and C.5 for the Member States of consumption indicated. It should be noted that the value of the amount of output VAT for specific Member State of consumption can be in negative (in the case of adjustments in minus).

This section should report supplies of goods from warehouses in Poland to buyers from other EU countries. In each part of this section, the values of total sales in the given settlement period to a specific EU country should be reported.

Individual items should be completed as follow:

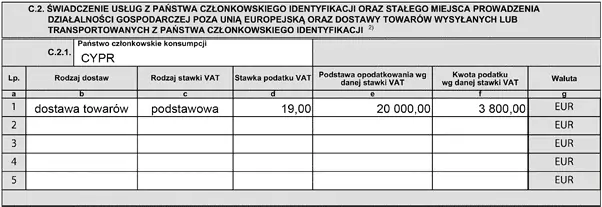

A taxpayer registered for the EU procedure in Poland has made supplies of goods to Cyprus in the third quarter of 2025 for €20,000 (VAT rate 19%).

The supply transactions to this country should be reported in the VAT return (VIU-DO) as follows:

This section should report deliveries of goods from warehouses in countries other than Poland to buyers in EU countries other than the country of dispatch. In each part of this section, the values of total sales in the given settlement period to a specific EU country should be reported.

Individual items should be completed as follows:

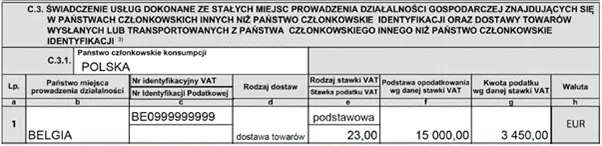

A taxpayer registered for the EU procedure in Poland made supplies of goods from a warehouse in Belgium to Poland in the third quarter of 2025 for €15,000 (VAT rate 23%).

The supply transactions to this country should be reported in the VAT return (VIU-DO) as follows:

Limited liability company in the Czech Republic (in Czech: Společnost s ručením omezeným | s.r.o.) is the most common form of business. This company exists independently of its shareholders, and it may be formed either by one person (a natural or legal person) or more persons (the maximum number of persons is not set).

A limited liability company (in Czech: Společnost s ručením omezeným | s.r.o.) is the most common form of business in the Czech Republic. This company exists independently of its shareholders, and it may be formed either by one person (a natural or legal person) or more persons (the maximum number of persons is not set).

| Supreme Body |

General meeting; or Sole shareholder who exercises the powers of the general meeting |

| Statutory Body | One or more managing directors |

| Supervisory Board (optional) | Optional body which supervises the managing directors, various documents, and accounts |

The incorporation procedure of a limited liability company in the Czech Republic consists of the following steps:

Adopting the Memorandum of Association / Foundation Deed by the Notary Public

Arranging consent to the provision of the company’s registered office address

Registering the necessary trade licences of the limited liability company in the Czech Republic

Opening a bank account for contribution payments

Registration of the company in the Commercial Register of the competent District Court

The incorporation time of a limited liability company in the Czech Republic is approximately 1 week after receiving the incorporation documentation.

We will prepare all the necessary documents and advise you on the formalities (e.g., notarisation, legalisation).

We will incorporate the company and proceed with all the steps under the powers of attorney granted to us.

Once the limited liability company in the Czech Republic is duly incorporated, we will guide you through all the necessary steps and registrations and help you with them.

Does a managing director of a limited liability company in the Czech Republic have to be of Czech nationality?

No, the managing director can be of any nationality.

Can we incorporate the limited liability company in the Czech Republic remotely or is our personal presence required?

All but one of the steps can be arranged remotely by a power of attorney. The only step that requires personal presence is the opening of a current bank account once the company is duly incorporated.

Is personal presence required for opening a current bank account?

Yes, the personal presence of the person who will be authorised to use the bank account (usually the managing director) is necessary. This is due to European legislation which sets strict conditions on AML and compliance policy.

Who is an Ultimate Beneficial Owner (UBO)?

The beneficial owner is every natural person who directly or indirectly owns more than 25% of participation in the capital or voting rights in the company; or who is entitled to a share of profit exceeding 25%; or who exercises actual control over the company on other grounds. Other grounds may refer to a partnership agreement, for example.

What is the time limit for registering the UBO after the incorporation, and what are the sanctions in case the UBO is not registered or is registered improperly?

The Czech law does not provide a precise time limit for the registration of UBO. However, it states that the registration should be made without undue delay. In practice, this usually means within two weeks after the incorporation.

Companies that fail to register the UBO without undue delay may face the following consequences:

What is a Data Box?

The Data Box represents a secure and state-guaranteed electronic communication portal, which can be used to communicate with authorities, courts or other entities, including private entities. It is a kind of e-mail box established upon the registration of each company. As part of our service, we can manage your Data Box and keep you informed of messages received and other necessary actions. The Data Box interface is only available in Czech.

What is the corporate income tax for a limited liability company in the Czech Republic?

Corporate income tax is levied at a standard rate of 21%. Find out more about taxation in the Czech Republic in our dedicated tax guideline.

What is a contract on performance of the office of a member of the statutory body, and is a company obliged to conclude it with its managing directors?

The essence of this contract is to regulate the rights and obligations of the company and the members of the statutory body in their mutual relationship. In practice, this contract is usually concluded (and recommended by us), but it is not obligatory. If the contract on performance of the office of the member of the statutory body is not concluded, it is established that the members of the statutory body perform their function without remuneration and the relationship between the statutory body and the company is governed by the provisions of the Czech Civil Code.

*This list is not exhaustive

A joint-stock company is another form of business in which share capital consists of shares which are represented by securities. The company may be established by a sole shareholder. It can be formed either through a private agreement to subscribe to all shares or via a public offering.

A branch (in Czech: odštěpný závod) is a part of a company located in a different country from the parent or founding company. It is an economically and functionally independent part of the parent company, which is registered in the Commercial Register. It has its own registration number, registered office and its own accounts.

With a market of considerable potential, a strategic location, and a well-educated workforce, Romania continues to offer attractive opportunities for investors. However, the beginning of 2025 brings significant challenges due to the economic slowdown and stricter fiscal measures. GDP growth has been significantly lower compared to previous years, reaching only 1.5%, while the budget deficit has risen to 8.6% of GDP, creating additional pressure on the business environment.

Following its accession to the European Union in 2007, Romania continued the process of aligning with European directives, benefiting from funding for modernization and economic development. Nevertheless, in 2025, companies face a more restrictive tax regime, marked by the increase of the dividend tax from 8% to 10%, the reduction of the income threshold for microenterprises from EUR 500,000 to EUR 250,000, and the increase of the gross minimum wage to RON 4,050. These measures have a direct impact on operational costs and require greater focus on tax compliance and financial planning.

While Romania remains an attractive destination for investment, the fiscal environment is becoming more unpredictable, and companies must adapt their strategies to optimize costs and avoid risks associated with new regulations. As a result, outsourcing tax and accounting services is becoming an increasingly relevant solution for ensuring compliance and improving internal efficiency.

We hope the new Tax Guideline for Romania will provide all the necessary information for those who consider doing business in Romania, as well as for already existing businesses.

EU and EEA citizens can buy real estate properties (land and buildings) in the same conditions as Romanian citizens.

Non-UE/EEA citizens may acquire buildings in Romania, while land may be acquired only if there is an international agreement in place which also allows Romanian citizens to acquire land in the respective countries.

Before starting the investment in the Romanian market, the investors have to decide upon the legal form of business which will be used.

The types of business forms are stipulated by Law no. 31/1990 as republished and subsequently modified and completed, and there are compiled in the next table with specific information: the minimum share capital, the liability of the shareholders/stockholders, the minimum number of shareholders/stockholders.

The most common forms of business used in Romania are the Limited Liability Company along with the Joint Stock Company and Branches.

| The form of business | Minimum capital (approx. in EUR) | Shareholders´ liability | Number of shareholders | |

| English | Romanian | |||

| General Partnership | Societate in nume colectiv (S.N.C.) | N/A | The shareholders have unlimited and joint liability for social contributions. | No less than 2 |

| Limited Partnership | Societate in comandita simpla (S.C.S.) | EUR 0.4 |

The limited partners have no management authority and they are not responsible for the debts of the partnership. They respond in the limit of the subscribed shares. The general partners have management control and they have joint and several liabilities. |

At least one limited partner and at least one general partner. |

| Limited Liability Company | Societate cu raspundere limitata (S.R.L.) | EUR 0.2 | The shareholders respond in the limit of the contribution to the share capital. | 1 – 50 |

| Joint Stock Company | Societate pe actiuni (S.A.) | No less than EUR 25,000 | The stockholders respond in the limit of the subscribed shares. | No less than 2 |

| Company limited by shares | Societate in comandita pe actiuni (S.C.A.) | No less than EUR 25,000 |

The limited partners have no management authority and they are not responsible for the debts of the partnership. They respond in the limit of the subscribed shares. The general partners have management control and they have joint and several liabilities. |

No less than 2 |

| Branch | Sucursala | N/A | The Mother Company is liable for its branch. | N/A |

| Sole entrepreneur | Persoana fizica autorizata (P.F.A.) | N/A | The sole entrepreneur is also the sole responsible. | N/A |

Social security and health insurance assessment base of an employee in Romania is derived from salary income.

| Payrolls and Contribution | Employee | Employer |

| Income tax | 10% | N/A |

| Health insurance contribution | 10% | N/A |

| Social (Pension) insurance contribution | 25% | N/A |

| Work insurance contribution | N/A | 2.25% |

Residents of the EU are covered by the provisions of EC Regulation 883/2004 regulating social security and health insurance rules in case of cross-border activities.

| Main features of employment relationship | Applicable law | |

| Contract type | Individual labour agreement for definite period, indefinite period, home-based work, telework, part-time or full-time work, temporary staffing, etc. | Law No. 53/2003 Labour Code |

| Contract must include |

Parties, duration of the contract date of the contract conclusion, work conditions, the place where the work is performed, evaluation criteria of the employee, the occupation, the risks of the job, number of vacation days, number of days applicable for the notice, number of working hours per day and/or per week, probationary period and its conditions if any, the date of commencement of work, base salary, other elements constituting the salary income, separately recorded, periodicity of payment of the salary to which the employee is entitled and method of payment, etc. (The contract must be concluded in writing) |

|

| Working time |

Full time employees – 8 hours/day and/or 40 hours/week Part time employees – the number of normal working hours, calculated weekly or as a monthly average, is less than the number of normal working hours of a comparable full-time employee. The working time is determined by the daily norm thus weekly norm represents daily norm*no. of working days (5 days). Working time is any period during which the employee performs work, is at the employer’s disposal and fulfils his/her tasks and duties, in accordance with the provisions of the individual employment contract, the applicable collective labour contract and/or the legislation in force. |

|

| Holiday entitlement per year | Minimum 20 working days per year. | |

| Trial period | For indefinite labour agreements depending on the nature of the position:

For definite labour agreements:

|

|

| Notice Period |

|

The standard corporate income tax rate is 16%.

Taxpayers that are carrying on activities such as gambling and nightclubs are either subject to 5% rate of the revenue obtained from such activities or to 16% of the taxable profit, depending on which is higher.

Companies with a turnover higher than EUR 50,000,000 in the previous year and which in the concerning year determine a corporate income tax lower than the minimum tax on turnover are required to pay corporate income tax at the level of a minimum tax on turnover. The minimum tax on turnover is determined as 1% of total income to which certain tax adjustments are made

Companies operating in the oil and gas sectors are additionally required to pay a supplementary turnover tax of 0.5% of their total revenues.

A company is considered as resident in Romania if it is set-up under Romanian law, has its legal seat or its place of effective management in Romania.

Resident companies are taxable on their worldwide income, unless a double tax treaty stipulates otherwise.

The taxable profit of a company is calculated as a difference between the revenues and expenses registered according to the applicable accounting regulations, adjusted by deducting non-taxable revenues and tax deductions and by adding non-deductible expenses. Also, elements similar to revenues and expenses are taken into account when calculating the taxable profit.

Non-resident companies that are carrying on activities in Romania through a permanent establishment are required to pay corporate income tax for the taxable profit attributable to the permanent establishment.

The calendar year or the fiscal year for the companies that have chosen, according to the applicable accounting regulations, to apply a fiscal year different from the calendar year.

As a general rule, the corporate income tax is calculated quarterly. For the first three quarters the filing and the payment of the corporate income tax is performed quarterly, until 25th of the first month following the end of the quarters. The final computation and payment of the corporate income tax for the whole calendar year is to be performed until March 25th of the following year.

There are exemptions from the above general rule that apply to companies such as:

Taxpayers, except those who are specifically mentioned by law, may opt to declare and pay the annual corporate income tax by making quarterly advance payments. The anticipated quarterly advance payments are computed as ¼ of the previous annual corporate income tax updated by the consumer price index and are due by the 25th of the month following the end of the quarter. By exception, the quarterly advance payments related to fourth quarter are due by December 25th, respectively until the 25th of the last month of the changed fiscal year.

As a general rule, are considered deductible expenses those expenses which are incurred for the purpose of carrying on the business activity, unless they are specifically mentioned by law as limited deductibility expenses or non-deductible expenses.

Annual tax losses determined by way of the corporate income tax return, beginning with 2024/amended tax year beginning in 2024, as the case may be, shall be recovered from the taxable profits realized up to maximum 70%, in the following 5 consecutive years. Recovery of losses will be made in the order in which they are incurred, at each income tax payment date.

Companies can benefit from an additional deduction of 50% of the eligible expenses for their Research and Development (R&D) activities. Furthermore, accelerated depreciation for devices and equipment used in the R&D activities may be applied.

The 50% additional deduction from the R&D expenses will not be recomputed in case the objectives of the project are not met.

In order to benefit from these incentives, the eligible R&D activities should be from the applicative research categories and/or technological development relevant to the company activity and the activities should be performed in Romania, as well as in the European Union or in other states – member states of the European Economic Area.

Incentives are granted separately for R&D activities of each project.

The profit invested in new and specific technological equipment manufactured and/or purchased released for use is exempt from income tax. In order to benefit from this incentive, the technological equipment should be used by the company for the purpose of carrying on the business activity for more than half of its useful life, but for no longer than five years. The companies benefiting from this incentive cannot use the accelerated depreciation method for the respective technological equipment.

As a general rule, dividends paid by a Romanian company to another Romanian company are subject to 10% tax. However, the dividends paid are non-taxable if the beneficiary of the dividend has held, at the time of the distribution, a minimum of 10% of the Romanian company for an uninterrupted period of at least one year.

The applicable WHT rates in relation with non-resident companies are:

As a general rule, dividends paid to non-resident companies are subject to 10% withholding tax.

However, as Romania is an EU member state, the EU Parent-Subsidiary directive can be applied. Therefore, dividends paid by Romanian companies to resident companies in one of the EU member states are exempt from taxation if the beneficiary of the dividend has held, at the time of distribution, a minimum of 10% of the shares of the Romanian company for an uninterrupted period of at least one year.

As a general rule, the interest paid to non-resident companies is subject to 16% withholding tax.

However, as Romania is an EU member state, the EU Interest and Royalties Directive can be applied. Therefore, interest paid by Romanian companies to resident companies in one of the EU member states are exempt from taxation if the beneficiary of the interest has held, prior to the time of payment, at least 25% of the share capital of the Romanian company for an uninterrupted period of at least two years.

As a general rule, royalties paid to non-resident companies are subject to 16% withholding tax.

However, as Romania is an EU member state, the EU Interest and Royalties Directive can be applied. Therefore, royalties paid by Romanian companies to resident companies in one of the EU member states are exempt from taxation if the beneficiary of the interest has held, prior to payment time, at least 25% of the Romanian company´s share capital for an uninterrupted period of at least two years.

Thin capitalization rules have been repealed as of 2018. Therefore, as of January 1, 2018, the Tax Code introduces a new concept – exceeding borrowing costs – defined as the difference between interest expense and interest income as well as other equivalent expenses/income. The total exceeding borrowing costs resulting from transactions/operations carried out both with related and non-related parties may not exceed the deductible ceiling represented by the RON equivalent of the amount of EUR 1,000,000. However, exceeding borrowing costs resulting from transactions/operations which do not finance the acquisition/production of fixed assets under construction/assets established according to the law and which are carried out with related parties, are deductible, in a tax period, up to the deductible ceiling represented by the RON equivalent of EUR 500,000.

The exceeding borrowing costs exceeding the threshold of EUR 1,000,000 may benefit from an extra deduction, limited to 30% of the accounting profit adjusted negatively with non-taxable income and positively with income tax expenses, exceeding borrowing costs and deductible tax depreciation. If the resulting base is zero or negative, the exceeding borrowing costs is non-deductible in the current period, but can be recovered for an unlimited period of time and can be deducted in subsequent periods applying the same mechanism.

A corporate taxpayer who controls a foreign company includes in its taxable base undistributed income derived from: interest, royalties, dividends, income from the transfer of shares, income from financial leasing, insurance income, banking activities, etc.

An entity is considered a controlled foreign company if the following conditions are met:

Transactions performed between two Romanian related persons, as well as between related Romanian persons and non-resident persons, are subject to transfer pricing rules.

A legal entity is related with another legal entity if at least one of the cases below is applicable:

Transactions between related parties should use the arm’s-length principle. In case the transfer prices are not set at arm’s length, the fiscal authorities have the right to adjust the amount of revenue and expense in order to reflect the market value.

In order to apply the provisions of the relevant Double Taxation Treaty (DTT), the non-resident recipient of the income should provide to the Romanian payer a tax residence certificate attesting its tax residency for the purpose of the DTT.

In case the tax rates mentioned in the domestic legislation differ from the rates mentioned in the applicable DTT, then the most favourable rate will apply.

At this moment, incomes obtained by individuals are taxed with 10%.

Personal income tax regarding incomes from salaries is governed by the Fiscal Code (Law 227/2015).

Romanian State established as income tax free several categories of employees:

Employees with severe or pronounced disabilities – the tax exemption is granted only under strict conditions verified by Romanian medical system.

Employees who work in Research and Development (R&D) or Technological Development field – the tax exemption is granted if certain conditions are met as per law provisions.

The tax period equals the calendar year.

The personal deduction comprises the basic personal deduction and the additional personal deduction and is granted within the limit of the monthly taxable income earned.

The basic personal deduction is granted to individuals who have a gross monthly income of up to 2000 lei above the level of the minimum gross basic salary in force in the month of income. The Tax Code also introduces changes to the methodology for calculating the personal deduction.

The additional personal deduction is granted as follows:

For example, voluntary health insurance premiums and medical services provided through a subscription, as well as voluntary pension contributions covered by employers for their own employees, are tax-deductible for salary tax purposes up to a limit of EUR 400 per year for each category.

During the period of delegation, employees are entitled to payment of travel and accommodation expenses and a delegation allowance.

Delegation is the temporary performance by an employee, at the employer’s request, of work or tasks corresponding to the employee’s duties outside the workplace.

The delegation allowance or daily subsistence allowance, as it is also known in practice, is the daily amount granted, for example, to cover the cost of food, the usual incidental expenses and the cost of transport within the locality where the employee works.

The maximum deductible limit applicable for daily allowances granted by the Company, inside Romania or abroad represents 2.5* the daily subsistence allowance of the legal level established for the delegation/posting allowance, by Government decision, for staff of public authorities and institutions, up the maximum value of 3 basic salaries.

The values that exceed the maximum limit mentioned above are considered benefits and must be included in the category of income salaries and salary-related income.

| Daily allowance in EU countries (with some exceptions) | ||

| Interval | Minimum | Maximum tax deductible up to |

| 01.12.2012 – present | EUR 35 | EUR 87.50 |

| Daily allowance in Romania | ||

| Interval | Minimum | Maximum tax deductible up to |

| 01.04.2023 – present | RON 23 | RON 57.5 |

Individuals who meet at least one of the following conditions are considered to be resident individuals in Romania:

All other individuals are considered to be non-residents. EU residents are subject to the rules of EC Regulation 883/2004 on social and health security for cross-border activities.

The standard VAT rate in Romania is 19%.

A reduced rate of 9% applies to water, food & beverage industry, hotel accommodation, restaurant and catering services, provision of social housing under certain conditions, entrance fees to sports events.

Extra-reduced rate of 5% applies to schoolbooks, newspapers, magazines, including those recorded on electromagnetic or other media, entrance fees to castles, museums, memorial houses, zoos, botanical gardens, and similar institutions.

VAT rules are based on the principles of the Council Directive 2006/112/EC on the Common System of Value Added Tax. The Directive is implemented in the Romanian law by Law No 227/2015 and related Methodological Norms.

Legal entities and individuals that carry on independently an economic activity.

Total consideration charged for the supply, excluding VAT but including any excise duties or other taxes and fees. In some cases, between related parties, the taxable amount consists of the market value.

The standard fiscal period is the calendar month.

For taxable persons whose previous year-end turnover is lower than EUR 100,000 and did not perform intra-Community acquisitions of goods, the fiscal period is the calendar quarter.

Periodical VAT returns (monthly or quarterly, by the 25th day of the following month) and the Local Sales and Purchases List (monthly, by the 25th day of the following month). The payable VAT liability consists of the output VAT, due on supply of goods and services carried out, less the input VAT of the same period (monthly or quarterly, by the 25th day of the following month). The refundable VAT (when input VAT is higher than output VAT) can be requested for refund or carried forward until the statute of limitation period expires (5 years).

In addition, taxable persons carrying out intra-Community operations with goods or services with the place of supply according to the basic rule for “business to business” services have to file an EC Sales List (that shows the VAT identification numbers of his business partners and the total value of all the supplies of goods and services performed by the entrepreneur) on a monthly basis depending on the situation.

Submission through electronic means is available.

All above tax statements are to be prepared based on the information presented in the VAT Sales and Purchase Ledgers.

Reverse charge applies for the intra-Community acquisitions, where both parties are registered for VAT purposes. Local reverse charge is applicable in some cases between two Romanian VAT payers, for example:

The system is optional for taxpayers with a previous year turnover lower than RON 4,500,000and for the newly set-up companies. The right to deduct the input VAT for the acquisitions of goods/services from companies applying the system is deferred until the payment is performed.

Starting 1st of January 2024, B2B e-invoicing has become mandatory.

The mandatory VAT registration for taxable persons having the place of business activity in Romania should be performed when the annual turnover of EUR 88,500 (RON 300,000) is exceeded. Voluntary VAT registration before the threshold is exceeded is also possible.

Non-resident taxable persons established in Romania through fixed establishments and non-residents having no actual presence in Romania can register without observing the above threshold. However, a VAT number must be in place before the commencement of the economic activity.

A foreign taxable person that makes long-distance sales (mail order business) to any non-taxable person or that is not registered for VAT in Romania must register for VAT in Romania if the total annual value of the goods/supplies reaches EUR 35,000 (RON 118,000).

Taxable person not registered for normal VAT purposes in Romania and not required to register are liable to register as an identified person (special VAT registration) in the following situations:

Companies that are legally independent but are closely related financially, economically and from an organisational point of view may form a tax group, if administered by the same tax office and having the same tax period. Transactions between the members of the group will still fall within the scope of VAT.

To opt for the microenterprise income tax regime, the following conditions must be met as of December 31 of the previous year:

The tax period equals the calendar year.

Payment of the tax and filing of the returns is made quarterly, by the 25th day of the month following the end of the quarter for which the tax is calculated.

For buildings owned by companies, the following tax rates are applicable:

Building tax is paid annually in two equal instalments, until March 31st and September 30th.

The building tax is due for the entire tax year by the person who owns the building as of December 31st of the prior tax year.

The owners of land are subject to tax on plots of lands. The Local Council establishes a fixed amount per square metre, depending on the rank of the area where the land is located and the category of land use.

Tax on plots of land is paid annually in two equal instalments, until March 31st and September 30th.

The tax is due for the entire tax year by the person who owns the land as of December 31st of the prior tax year.

The tax on transportation means in Romania is paid by any person that owns a mean of transportation.

The tax rate varies from RON 8 to RON 290 depending on the cylindrical capacity of each vehicle, for each 200 cm3 or a fraction thereof.

The tax on transportation means is paid annually in two equal instalments, until March 31st and September 30th.

The tax on transportation means is due for the entire tax year by the person who owns the mean of transportation as of December 31st of the prior tax year.

The following categories of taxpayers are liable to pay the special tax on high-value assets:

Tax payment deadlines and submission of tax returns:

Starting January 1, 2025, Romanian and foreign companies owe a construction tax in Romania, calculated by applying a 1% rate to the value of constructions recorded in the company’s assets as of December 31 of the previous year. From this value, the taxable value of buildings already subject to the building tax (as provided by Title IX of the Fiscal Code) will be deducted.

The following products are subject to excise duties: alcohol and alcoholic beverages, manufactured tobacco products, energy products and electricity.

Goods imported from non-EU countries are subject to import customs clearance.

Individuals working in the Research & Development field may benefit from an exemption from the standard 10% income tax, under certain conditions expressly mentioned in the Romanian domestic legislation.

Companies doing business in Romania could benefit from the following incentives:

Beyond our free tax guideline for Romania, we’re ready to support you with hands-on expertise tailored to your business needs. Accace offers comprehensive tax advisory and tax compliance services in Romania to help you navigate local regulations, optimize your tax strategy, and stay fully compliant. Whether you’re entering the market or already operating in Romania, our local experts are here to make sure your tax matters are in good hands. Get in touch with us today!

In general, Polish citizens, as well as Polish companies can purchase and sell real estates. Similar rules apply to citizens and companies from EU and EEA member states.

During the procedure of accession to European Union, Poland negotiated 12-year grace period of protection with regard to agricultural parcels. During this period EU residents were obliged to obtain a permit to purchase agricultural parcels. This protection period has ended in May 2016.

Nevertheless, there are still some restrictions concerning acquisition of the agricultural parcels. They apply to all potential purchasers, regardless the nationality.

Sale of agricultural parcels which are the state property has been suspended until April 30th, 2026. There are also restrictions concerning sale of agricultural parcels owned by private persons. Detailed rules of acquisition of agricultural parcels are presented below.

The ownership of the real estate may be transferred by conclusion of several types of agreement, e.g.:

purchase

exchange

donation agreement

The agreement obliging to transfer the ownership of real estate must be executed in the form of notarial deed. The ownership of a real estate cannot be transferred conditionally or with a reservation of a time limit.

The common practice is to conclude preliminary agreement prior to conclusion of the main agreement. Legal consequences of such agreement will differ depending on its content and the form in which it was concluded. If preliminary agreement was concluded in form required for the main agreement (in this case notarial deed) entitled party may pursue conclusion of the agreement in court even if the other party refuses to fulfil its obligation. However, if preliminary agreement does not fulfil formal requirements, entitled party may only demand payment of compensation for the damage caused by the lack of conclusion of the agreement.

The ownership of the real estate may be also acquired by so-called usucapion (acquisitive prescription). In the event of adverse possession of a real estate (i.e. occupation without legal title), possessor of real estate acquires ownership of this real estate after specified period. The period depends on good faith of the possessor and amounts to 20 years – in case of good faith – or 30 years – in case of bad faith – of uninterrupted possession of the real estate.

The majority of real estate in Poland are disclosed in land and mortgage registers. The registers are held by district courts and are public. They may be viewed free of charge on the website of Ministry of Justice.

Prior to conclusion of the agreement the purchaser should verify the legal condition of real estate he/she intends to buy in land and mortgage register. To check the real estate’s register the purchaser will need its registry number. The purchaser should in particular check the information about the owners of the real estate and any possible rights of third persons in relation to the real estate, e.g.: mortgage.

Polish law guarantees the authenticity of the information disclosed in the land and mortgage register. It means that in case of acquisition of the ownership or other right ad rem to a real estate from the person disclosed in land and mortgage register as the owner, the acquisition is valid even if this person was not in fact the owner of the real estate. However, such protection does not apply to the purchaser who knew about the inconsistency of the register or could have easily learnt about such inconsistency.

If the real estate is not registered in land and mortgage register, the purchaser should check land and building records. These records do not contain information as detailed as the land and mortgage register. Nevertheless, they include all basic information, such as real estate’s owners, their addresses of residence or seats, cadastral value of the property etc.

The agreement which transfers the ownership of a real estate has to be executed in the form of notarial deed or else it will be invalid.

Notary fee for preparation of a notarial deed depends on the value of sold real estate. However, the fee cannot exceed PLN 10,000.

The notary will also calculate due civil law transaction tax. The tax is paid to the notary at the conclusion of the agreement. The notary is obliged to transfer it to the relevant tax office.

After the conclusion of the agreement the purchaser of the real estate should file a motion for update information disclosed in land and mortgage register. The motion should be filed in the relevant district court. The court fee amounts to PLN 200. There is also a possibility to ask the notary to do it for us.

In the event of lack of land and mortgage register, the purchaser may establish such register for the purchased real estate. This also requires a motion to the district court with jurisdiction over the location of the property. The court fee in such case amounts to PLN 60.

The purchaser of real estate should also inform relevant municipal office about the change of the owner of the real estate in order to provide information about new payer of the property tax.

Acquisition of real estate in Poland by foreigners is regulated by the Act on Acquisition of Real Estate by Foreigners dated March 24th, 1920 (Official Journal from 2017, position 2278).

According to this Act the foreigner is:

Under the Act acquisition of perpetual usufruct requires fulfilment of the same conditions as acquisition of ownership.

The acquisition of real estate by a foreigner requires a permit. The permit is issued by the Minister of Internal Affairs. The Minister of National Defence or the minister competent for rural development (in case of agricultural parcels) have a right to oppose such acquisition.

The permit is issued upon the foreigner’s request if:

the acquisition of real estate does not threaten the defense or security of the state or the public order, as well as if the interest of social policy and public health do not oppose to such acquisition;

foreigner proves that there are circumstances which confirm his/her ties with the Republic of Poland (e.g. Polish nationality, marriage with Polish citizen, doing business in Poland in accordance with Polish law etc.).

Permit is also required in case of acquisition of shares in a company with its seat in Poland by foreigners, as well as any other legal action concerning shares of the company, if:

Acquisition of a real estate which violates the provisions of the Act on Acquisition of Real Estate by Foreigners is null and void.

Most of the limitations do not apply to residents of member states of European Union, European Economic Area and Swiss Confederation.

In general acquisition of agricultural parcel is reserved for so-called “individual farmers”.

Individual farmer is a term introduced by the Act on Shaping the Agricultural System dated April 11th, 2003 (Official Journal from 2022, position 2569) and means a natural person, who:

The acquisition of the agricultural parcels by persons who are not individual farmers is possible in particular in the following cases:

The acquisition of agricultural real estate by entities other than those mentioned above may also occur with the consent of the Director-General of the National Center, expressed through an administrative decision issued upon request, but only in specific cases defined by regulations.

The purchaser of the agricultural parcel is obliged to run the farm, which was a part of acquired agricultural parcel for at least 10 years from the date of acquisition. If the purchaser is a natural person – he/she is obliged to fulfil this requirement personally.

During this 10-year period the acquired agricultural parcel cannot be sold or given into the possession of other person.

The tenant of agricultural parcel, who fulfils requirements specified in the Act on Shaping the Agricultural System, has a priority in purchasing it. If there is no tenant entitled to priority right or if he/she does not exercise this right, the priority in purchasing the agricultural parcel is passed to the State Treasury.

The above rules do not apply if:

The requirements regarding the transaction of agricultural real estate introduced by the Act on Shaping the Agricultural System do not apply when the arable land area in the sold real estate is a maximum of 0.2999 hectares.

As mentioned above, real estate can be sold either through a direct sale of the property (an asset deal or enterprise deal) or indirectly through sale of shares in the company owning the property (a share deal). These three types of transactions have different tax implications under the Polish tax regulations.

The revenues derived from the sale of real estate are subject to the standard taxation rules of Polish corporate income tax. Taxable revenues are reduced by the net book value of the property. Thus, effectively, only the “capital gain” is taxed at the rate of 19%. If the sales price differs substantially and without a justified reason from the market value of the real estate, the revenue may be assessed by the tax authorities according to the market value. This price adjustment may be applied to transactions between related and unrelated entities.

Costs incurred by the buyer for the acquisition of real estate: purchase price, transaction costs including advisory, civil law transaction tax – if applicable, financial costs accrued till the purchase, etc., are to be allocated to the initial value of the real estate and are recognized as tax deductible costs through depreciation write-offs or upon sale. As the value of the land is not subject to depreciation.

The supply of buildings, infrastructure, or parts of buildings or infrastructure is generally VAT exempt, except for:

in which cases the supply of buildings, infrastructure or parts of buildings or infrastructure are generally subject to VAT.

“First occupation” is understood as handing over a building, infrastructure or part of a building or infrastructure within the context of the performance of VAT-able activities (subject to VAT or VAT exempt) to the first acquirer or user, after the:

of that building, infrastructure or part of a building or infrastructure.

Taxpayers may choose not to apply the exemption and charge VAT if:

The supply of buildings, infrastructure or parts of buildings or infrastructure which should be subject to VAT (i.e. supply in the course of first occupation or within two years of the first occupation) must be VAT exempt (no option to tax allowed) if:

The VAT treatment of transfer of land or perpetual usufruct (RPU) over in general the VAT treatment of the buildings developed on the land.

However, if an RPU is acquired for the first time from the State or local authority, the transfer is always subject to 23% VAT, even though the buildings developed on the land may be exempt from VAT.

The supply of ownership title / RPU to undeveloped land qualified as land for development purposes is subject to 23% VAT (supply of agricultural land exempt from VAT).

Supply of residential buildings and separate apartments is subject to a reduced 8% VAT, except for part of residential buildings whose usable floor space exceeds 300 m2 and apartments whose usable floor space exceeds 150 m2. In such a case the part exceeding the thresholds is subject to a 23% VAT rate.

If the supply of real estate is VAT exempt, it is subject to civil law transaction tax payable by the buyer. The applicable rate is 2% of the market value of the real estate. This tax is levied on the total value of the building, infrastructure, or parts thereof, and the land / RPU.

Input VAT is recoverable if the company performs or intends to perform activities in the future which are subject to VAT (e.g. lease of the commercial real estate). Input VAT will not be recoverable if the company performs or intends to perform activities in the future which are VAT exempt. If this is the case, the input VAT will increase the initial tax basis of the real estate.

If business activities are partly exempt, any input VAT which cannot be matched directly either to VAT-able sales or VAT exempt sales may be recovered according to the proportion of the net value of the taxed supplies to the total value of all supplies (a so called pro rata recovery). During a calendar year, the proportion is calculated based on the volume of supplies made in the previous year. At the year end, the amount of deductions is adjusted to the actual percentage calculated for the whole year. In the case of real estate subject to depreciation for tax purposes, the percentage of input VAT which may be deducted is subject to adjustments over the period of 10 years. Taxpayers also need to take into account so called preliminary pro-rata that limits input VAT recovery on purchases, if linked both with the business of the taxpayer and other activities not related with business operations.

The right to recover input VAT arises in the period when the tax point with respect to the acquired goods or services arose (i.e. in the month in which the services were rendered, or the goods were acquired by the purchaser). It cannot be, however, recovered earlier than in the period in which the taxpayer receives the respective invoice (prepayment invoices do not fall under this rule: they must be paid in order for input VAT to be reclaimable).

A direct refund of any surplus input VAT should be made within 60 days of the submission of the application for the refund provided that in the period for which the refund is claimed the taxpayer performed VAT-able supply.

This deadline can be shortened to 25 days at a taxpayer’s request when a number of conditions are met, such as providing bank payment proofs for invoices, invoices paid in cash amount to less than PLN 15,000 in total.

In the case where VAT-able supplies are not made in the period for which the refund is claimed. The period for the refund is extended to 180 days, unless a form of security is provided (in which case the refund must be made within 60 days).

The revenues derived from the sale of an enterprise are subject to the standard taxation rules of Polish corporate income tax. Thus, effectively, only the “capital gain” is taxed at the rate of 19%.

Enterprise is an organized complex of material and non-material components designed for carrying on an economic activity.

Organized part of an enterprise are material and non-material components organizationally and financially separated in an existing enterprise, including liabilities, being designed for the fulfilment of specific economic tasks, which at the same time could constitute an independent enterprise carrying out these tasks on its own..

According to clarifications of the Ministry of Finance on VAT consequences upon sale of commercial real estates, if beside typical items sold together with a real estate, rights and obligations from debt financing agreements, property management agreement, asset management agreement and agreements on financial nature are transferred as well as the intention of the purchaser is to continue the business activity of the seller and such continuation is possible via purchased items such sale will constitute an enterprise deal transaction.

Sale of the enterprise or organized part of an enterprise is out of VAT scope.

Purchase of enterprise or organized part of the enterprise is subject to civil law transaction tax payable by the buyer. The applicable rate is 2% of the market value of the real estate, movables, etc. Other property rights may be subject to 1% TCLT rate (if separated in the sales agreement).

A capital gain on the sale of shares is subject to Polish corporate income tax at the standard rate of 19%.

If the selling party is a foreign shareholder, the applicable tax treaty influences the tax implications of such a transaction.

Significant part of Polish tax treaties (e.g. with Spain, France, Denmark, Sweden, Germany, Luxembourg) provide that a sale of shares in a company holding mainly real estate assets should be regarded as a sale of real estate. Consequently, income earned on the sale of shares in the Polish company will be taxed in Poland (the so called real estate clause).

The sale of shares in the Polish company is subject to a 1% civil law transaction tax (on the fair market value of shares) payable by the buyer. This is irrespective of where the transaction takes place or where the parties to the transaction are tax residents. A share transaction is not subject to Polish VAT. However, where a share transaction is treated as being made in the course of business activity (rather than as a one– off transaction), it may be classified as a VAT exempt financial service. However, it will still be subject to civil law transaction tax.

Costs which must be incurred in order to acquire shares (e.g. purchase price and notary fees) may be recognized as tax deductible costs upon the sale of shares.

Other costs indirectly connected with acquisition of shares such as financing costs may be recognized as tax deductible costs when incurred (in certain cases recognition over time may occur).

Handling real estate transactions in Poland requires not only legal precision but also deep knowledge of local procedures and regulations. Our Polish experts offer end-to-end support, from legal due diligence and contract drafting to tax advisory and compliance, ensuring your property deals are secure, efficient, and fully compliant. Whether you’re buying, selling, or investing, we help you navigate every step with confidence.

Company formation in the Czech Republic is regulated by the Civil Code and Business Corporations Act. Czech or foreign investors entering the Czech market may choose between several corporate forms. There are no limitations for foreign investors when it comes to setting up companies. A foreign natural or legal person may establish any form of company either together with other foreign or Czech persons, or alone as a sole shareholder. In this respect, foreign natural and legal persons enjoy the same rights and bear the same obligations as Czech persons and may not be discriminated against.

Our services for company incorporation in the Czech Republic are designed to simplify the process of starting a business. We offer tailored service packages to meet your specific needs, ensuring a smooth and hassle-free incorporation experience. Get in touch with us to find out more.

A General Partnership is a company in which at least two persons carry out business activities under a common business name and bear joint and several liabilities for the obligations of the partnership with all their property. There is no requirement of a minimum registered capital, nor for the minimal contribution.

A company in which one or more partners are liable for the partnership’s liabilities up to the amount of their unpaid contributions (limited partners), and one or more partners are liable for the partnership’s liabilities with their entire property (general partners).

The minimum contribution of the limited partner should be set in the Articles of Association. Again, there is no requirement of a minimum registered capital.

This is the most common form of doing business in the Czech Republic. The company exists independently of its members, and it may be established either by one (natural or legal) person, or by two or more persons (the maximum number of persons is not set).

According to the Business Corporations Act, the minimum contribution of each shareholder is in the amount of CZK 1.

A Limited Liability Company is liable for the breach of its obligations with all its assets, while shareholders guarantee for the breach of the obligations of the Limited Liability Company only up to their committed but unpaid contributions to the registered capital registered with the Commercial Register.

ESTABLISHING AN LLC IN THE CZECH REPUBLIC HAS NEVER BEEN EASIER

Did you know that LLC is the most common form of business in the Czech Republic? Benefit from our 2024 Limited Liability Company formation guide and learn more about the incorporation procedure, obligations and how we can help you with the establishment process.

The company may be established even by a sole founder. A Joint-Stock Company can be formed by a private agreement to subscribe for all shares, or via a public call for the subscription of shares.

The minimum registered capital required is CZK 2,000,000 or EUR 80,000.

The purpose of a Cooperative is to undertake business activities or to ensure the economic and social or other benefits of its members.

A Cooperative is a community of an indefinite number of persons, but it shall have at least 3 members.

The Business Corporations Act does not set out the amount of minimum registered capital or minimum contribution.

Foreign companies may conduct business in the Czech Republic provided that they have their business or branch offices located in the Czech Republic, registered with the Czech Commercial Register.

No minimum registered capital or contribution is required.

There are other 3 legal forms of business – entities primarily regulated by EU regulations – which are legally binding for all EU Member States:

The most important document required when establishing a company in the Czech Republic is the Articles of Association / Foundation Deed adopted in the form of a notarial deed.

Other documents required depend on the specific legal form of the company. Usually, the following documents are also required:

an affidavit of a managing director on their ability to perform on a position of statutory body of the company

a clean Criminal Register extract for non-Czech managing directors

a declaration on registered capital payment

a consent with the provision of a registered office address (from the office landlord)

Incorporation time varies based on company type. For example: the establishment and registration of a capital company could be completed within 7 working days.

In the following table we present an overview of possible setups of shareholders and other company’s bodies in the most used legal forms of business:

| Common setups | Limited Liability Company | Joint Stock Company | Limited Partnership | General Partnership |

| Shareholders | Natural person(s) or legal entity(ies) | Natural person(s) or legal entity(ies) | At least 2 natural persons or legal entities | At least 2 natural persons or legal entities |

| Company’s bodies |

Managing director(s) Supervisory board (voluntary) Sole shareholder or General meeting |

Monistic system: Management board Dualistic system: Board of directors, Supervisory board General meeting |

The statutory body consists of all of the General Partners. The Articles of Association may specify that the statutory body is formed of only some of the General Partners or one of them. | The statutory body consists of all of the Shareholders. The Articles of Association may specify that the statutory body is formed of only some of the Shareholders or one of them. |

Persons who will form the statutory body have to prove their clean criminal history by obtaining and submitting their criminal background check from their country of citizenship.

If the shareholder is a legal person, the proof of its existence (extract from a commercial register) shall be required.

Both corporate income tax residents and tax non-residents are subject to Czech corporate income taxes. A corporation is a tax resident if it is incorporated or managed and controlled from the Czech Republic. Tax residents are taxed in the Czech Republic on their worldwide income while tax non-residents only on their Czech-source income.

The taxable income is calculated on the basis of the accounting profits. As a general rule, expenses incurred on obtaining, ensuring and maintaining the taxable income are tax deductible.

Corporate income tax is levied at a general (standard) rate of 21%. Moreover, lowered corporate income tax rate of 5% applies to basic investment funds while pension funds are subject to a corporate income tax rate of 0%.

The tax period may be a calendar year or a fiscal year. The taxpayer has the obligation to calculate the tax due in the corporate income tax return (self-assessment). The time-limit for corporate income tax return filing is three or six months depending on certain conditions.

Advance tax payments are paid semi-annually or quarterly depending on the amount of the last known tax liability.

Find out more about taxes in the Czech Republic in our dedicated tax guideline.

Czech and foreign legal entities, as well as natural persons engaged in business activities in the Czech Republic, can apply for investment incentives. The supported areas include:

manufacturing industry

technology centres (R&D)

production of strategic products for the protection of life and health

strategic service centers

When meeting the conditions, investment incentives can be provided in the form of:

It is very important for the statutory body to act with due care and diligence when performing their role in a company. If the statutory body fails to comply with due care and diligence, it becomes liable for damages.

Unfortunately, this liability cannot be limited in any way (for example by an agreement with the company etc.).

In order to protect the statutory bodies, insurance companies in the Czech Republic provide a commercial insurance option, meant to insure against damages caused by the decisions of statutory bodies.

Rules on transfer pricing in Hungary are the applicable regulations for transactions between related parties as defined by the Hungarian Act on Corporate Income Tax (CIT). In general, we can say that if a company meets at least one of the following criteria, then it will be deemed as related parties for income tax purposes:

In addition, the Hungarian head office and the foreign PEs/branches, as well as the Hungarian PEs/branches and the foreign head office qualify as related parties; thus, the transfer pricing rules also apply to these enterprises.

Furthermore, the definition of related parties was supplemented as of January 1st, 2015. As a result of the changes, the concept of common directorship was added to the definition. Thus, even if the ownership (voting) rights of one entity in another entity do not exceed 50%, but the entities in question have the same management, then the two entities are considered related parties and are subject to the obligations prescribed by transfer pricing rules.

The Act on CIT defines the cases when entities are obliged to apply transfer pricing adjustments. According to paragraph 18 of the Act on CIT, transfer pricing adjustment is required if the price used between related parties based on their agreement is lower or higher than the consideration used by independent parties within comparative conditions. The profit before taxation shall be modified by transfer pricing adjustment in the following cases:

if the profit before taxation is lower due to the agreed consideration between related parties, the tax base shall be increased by transfer pricing adjustments

if the profit before taxation is higher due to the agreed consideration between related parties, transfer pricing adjustment could be made as tax base decreasing items