Get free access to

Our legislation updates make it easy for you to keep on top of the latest changes affecting your business. Receive our articles, opinions, tips, industry news, country profiles, regional overviews and studies, latest events and even more, directly into your mailbox.

Check out our Newsroom to see what is included!

We will send you only relevant information we consider may be of your interest and treat your personal data in compliance with our Privacy policy and GDPR statement.

Unable to subscribe? Try this page.

In the Official Gazette no. 817 of 04.09.2020 was published the GEO 153/2020 in Romania for the establishment of fiscal measures to stimulate the maintenance/increase of equity, as well as for the completion of some normative acts.

Thus, the taxpayers paying corporate income tax, microenterprise income tax and those paying tax specific to some activities benefit from reductions of the annual profit tax/income tax of microenterprises/tax specific to some activities, as follows:

A. 2% if the accounting equity is positive in the year for which the tax is due. For the taxpayers who, according to the legal provisions, have the obligation to establish the share capital, the accounting equity must simultaneously fulfill the condition of being at the level of a value at least equal to half of the subscribed share capital;B. If it registers an annual increase of the adjusted equity of the year the tax is due compared to the adjusted equity registered in the previous year and at the same time fulfills the condition provided at let. a), the discounts have the following values:

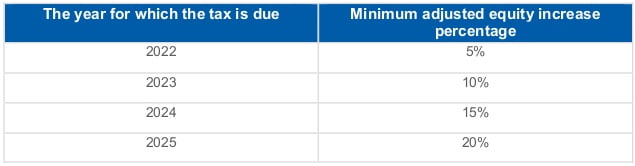

C. 3% if the taxpayers register an increase of the adjusted equity of the year the tax is due compared to the adjusted equity registered in 2020 above the level provided in the table below and if it simultaneously meets the condition of having the equity at the level a value at least equal to half of the subscribed share capital.

If two or three of the provided reductions are applicable, in order to determine the value of the reduction, the corresponding percentages are added together, and the resulting value is applied to the tax.

The Ordinance also provides some rules regarding the way taxpayers establish the adjusted equity of the previous year, respectively of 2020, applicable in the situation when, in the year for which the tax is due, reorganization operations are carried out, according to the law, which produce effects in that year.