Get free access to

Our legislation updates make it easy for you to keep on top of the latest changes affecting your business. Receive our articles, opinions, tips, industry news, country profiles, regional overviews and studies, latest events and even more, directly into your mailbox.

Check out our Newsroom to see what is included!

We will send you only relevant information we consider may be of your interest and treat your personal data in compliance with our Privacy policy and GDPR statement.

Unable to subscribe? Try this page.

The One Stop Shop or OSS in Poland procedure is an electronic one-stop shop for simplifying the settlement of output VAT on sales of goods and services to consumers from other EU countries, i.e. individuals who do not conduct business activities.

The premise of the OSS procedure in Poland is to enable settlement of VAT on the above transactions with the tax administration in one EU Member State. The taxpayer submits to one tax administration information on his sales of goods and services to individuals from other EU countries and pays the VAT. Based on the declarations submitted, the tax administration distributes and remits the appropriate part of the VAT paid in the country of identification to the relevant EU country of consumption.

The OSS procedure reduces the taxpayer’s obligations to register and settle VAT in different EU countries. Without OSS procedures, a supplier would generally be required to register in each Member State in which he sells goods or services to individuals.

There are two procedures available under the OSS procedure: the EU procedure and the non-EU procedure.

The EU procedure can be used, among others, by taxpayers established in the EU who:

Registration for the OSS procedure is made in a single Member State, the so-called Member State of Identification. In principle, the Member State of Identification is the Member State in which the taxpayer has its seat of economic activity.

The tax authority competent for the OSS procedure in Poland is the Head of the Second Tax Office Warsaw-Downtown.

To register for the OSS procedure, the following documents should be submitted:

Registration for the OSS procedure will be effective for taxpayer from the first day of the calendar quarter following the quarter in which the VIU-R form was submitted.

Once registration to the OSS procedure is done, then VAT must be declared and settled on all supplies of goods or services covered by this procedure.

This means that after registration via the OSS procedure, output VAT will have to be reported on supplies of goods to individuals from other EU countries. It regards also supplies of below services to individuals from other EU countries:

Once the OSS procedure has been notified, additional records of transactions covered by this procedure should be kept. These records are in electronic form and shall be kept for a period of 10 years from the end of the year in which the transaction took place.

These records should include the following data:

It should be emphasised that entities notified to the OSS are obliged to provide their records in electronic form whenever requested by the tax administration of both the Member State of identification and consumption.

A taxpayer registered for the OSS procedure in Poland is required to submit via the e-Declaration system: VAT returns (VIU-DO).

The return shall be submitted on a quarterly basis by the end of the month following each consecutive quarter.

The table below shows the deadlines for submitting VAT returns (VIU-DO).

| Settlement period – calendar quarter | Date of submission of return for OSS |

| Q1: 1 January do 31 March | 30 April |

| Q2: 1 April do 30 June | 31 July |

| Q3: 1 July do 30 September | 31 October |

| Q4: 1 October do 31 December | 31 January (next year) |

Amounts on the VAT return shall be expressed in euro and shall not be rounded up or down.

The VAT return for the OSS is supplementary and does not replace the VAT return that the taxpayer submits in his Member State as part of his domestic VAT obligations.

This means that after registering for the OSS procedure, taxpayer will be obliged to submit, as before, JPK_VAT files (in which should be reported, for example, retail sales in Poland and distance sales from warehouses in Poland to Polish buyers), and in addition will submit VAT returns (VIU-DO) by the end of the month following each subsequent quarter.

A taxpayer using the OSS procedure shall submit a VAT return for each calendar quarter, irrespective of whether the supply of goods or services covered by the procedure has taken place.

This means that if there are no activities covered by the OSS procedure and no adjustments have been made relating to previous returns of the settlement period, a nil VAT return (VIU-DO) shall be submitted.

It should be underlined that the VAT return (VIU-DO) cannot be submitted before the end of the settlement period.

The deadline for submitting the return also expires if that day falls on a Saturday or a public holiday.

Where mistakes are found in the VAT return (VIU-DO) submitted, the adjustment shall be made in the return submitted for the current tax period, but no later than 3 years after the expiry of the deadline for submission of the VAT return in which the mistakes were found.

The VAT return (VIU-DO) in which the correction is made shall indicate the Member State of consumption concerned, the tax period and the amount of VAT in respect of which the correction is made.

Nevertheless in the case of:

– an adjustment of the VAT return (VIU-DO) shall be submitted electronically via a special IT application to the Łódź Tax Office.

Payment of the VAT amount in respect of which the adjustment is made should be done in euro to the bank account of the Łódź Tax Office.

Once the VAT return (VIU-DO) has been submitted, it will be assigned a unique reference number (UNR).

The reference number (UNR) of the VAT return must always be indicated when making a payment. Without a reference number, it is not possible to make an effective payment and you should expect that such a payment will not be recognised and will be returned to the payer’s account.

The unique reference number for the EU procedure consists of the code of the Member State of identification, the VAT number and the period (quarter/year) for which the return is submitted.

An example of a UNR number for an EU OSS procedure is – PL/PLXXXXXXX/Q3.2023

The deadline for payment of VAT is the last day of the month following each consecutive quarter.

The deadline for submitting the return also expires if that day falls on a Saturday or a public holiday.

VAT resulting from the VAT return (VIU-DO) shall be paid in euro to the following bank account of the Second Tax Office Warsaw-Śródmieście:

The distribution of payments between the Member States of consumption is carried out by the tax authority on behalf of the taxpayer.

The Taxpayer intends to apply for the OSS procedure and report in its VAT return (VIU-DO) the distance selling of goods to individuals from various EU countries.

To correctly complete the return for the above transactions, it is necessary:

In addition in section C.5. adjustments to the VAT amounts indicated in the returns for previous periods resulting from corrections to supplies of goods or services (no later than 3 years after the deadline for submission of the original return) should be reported.

In section C.6. the balance of output tax should be reported for each Member State of consumption. This position is filled in automatically and is the sum of the VAT amounts from Sections C.2, C.3, C.4 and C.5 for the Member States of consumption indicated. It should be noted that the value of the amount of output VAT for specific Member State of consumption can be in negative (in the case of adjustments in minus).

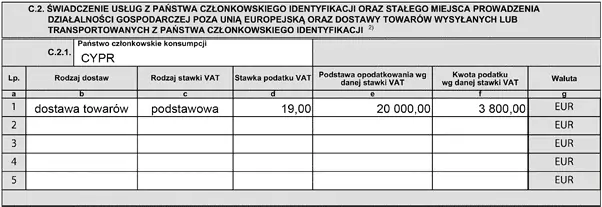

This section should report supplies of goods from warehouses in Poland to buyers from other EU countries. In each part of this section, the values of total sales in the given settlement period to a specific EU country should be reported.

Individual items should be completed as follow:

A taxpayer registered for the EU procedure in Poland has made supplies of goods to Cyprus in the third quarter of 2025 for €20,000 (VAT rate 19%).

The supply transactions to this country should be reported in the VAT return (VIU-DO) as follows:

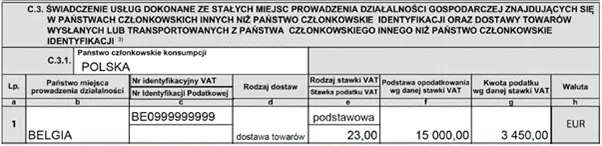

This section should report deliveries of goods from warehouses in countries other than Poland to buyers in EU countries other than the country of dispatch. In each part of this section, the values of total sales in the given settlement period to a specific EU country should be reported.

Individual items should be completed as follows:

A taxpayer registered for the EU procedure in Poland made supplies of goods from a warehouse in Belgium to Poland in the third quarter of 2025 for €15,000 (VAT rate 23%).

The supply transactions to this country should be reported in the VAT return (VIU-DO) as follows:

Sign up and get free access to our expert knowledge and valuable insights. You can unsubscribe from our mailing list anytime. Check also how we handle your data: Privacy policy | GDPR statement.

Already subscribed? Confirm your e-mail address below and receive your PDF directly in your inbox.