Get free access to

Our legislation updates make it easy for you to keep on top of the latest changes affecting your business. Receive our articles, opinions, tips, industry news, country profiles, regional overviews and studies, latest events and even more, directly into your mailbox.

Check out our Newsroom to see what is included!

We will send you only relevant information we consider may be of your interest and treat your personal data in compliance with our Privacy policy and GDPR statement.

Unable to subscribe? Try this page.

The concept of ultimate beneficial owners in the Czech Republic is of considerable importance in the fight against both money laundering and financing of terrorism. In general, it can be said that the purpose of identifying the ultimate beneficial owner is to strengthen the transparency of legal entities and legal arrangements and to reveal otherwise unclear or hidden structures. The ultimate beneficial owner is often verified, for example, in connection with the provision of public procurements, grants, or licenses.

An ultimate beneficial owner is every natural person who ultimately owns or controls, directly or indirectly, a legal entity.

The ultimate beneficial owner is defined as every natural person who directly or indirectly:

It is thus possible for a legal entity to have more than one ultimate beneficial owner, including persons who are important (in terms of having relatively significant participation in the legal entity), but do not have effective control in real terms.

Ultimate control (or influence) is exercised by a natural person who:

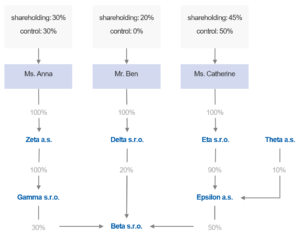

Example No. 1

Ms. Anna:

Indirect capital shareholding in Beta s.r.o. equals 30%.

Indirect ultimate control over Beta s.r.o. equals 30%.

Mr. Ben:

Indirect capital shareholding in Beta s.r.o. equals 20%.

Indirect ultimate control over Beta s.r.o. equals 0%.

Ms. Catherine:

Indirect capital shareholding in Beta s.r.o. equals 45%.

Indirect ultimate control over Beta s.r.o. equals 50%.

Ms. Anna and Ms. Catherine are the ultimate beneficial owners of Beta s.r.o.

The following entities do not have the ultimate beneficial owner:

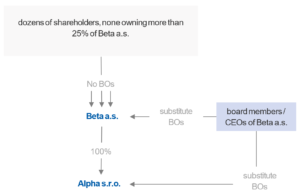

If all possible means of identifying the ultimate beneficial owners within the statutory definitions have been exhausted, provided that there are no grounds for suspicion, all members of the statutory body of the ultimate parent company are then registered as a substitute solution.

Substitute beneficial owners ensure day-to-day or strategic management of the ultimate parent company’s activities.

The substitute beneficial owner can only be considered in relation to corporations.

Example No. 2

The documents evidencing the ultimate beneficial owner’s position and the ownership structure of the legal entity are necessary for the registration. These may include the following:

All these supporting documents:

The registration or any updates in the Register of Ultimate Beneficial Owners must be initiated without undue delay (this is usually considered to be within 15 days) in the following situations:

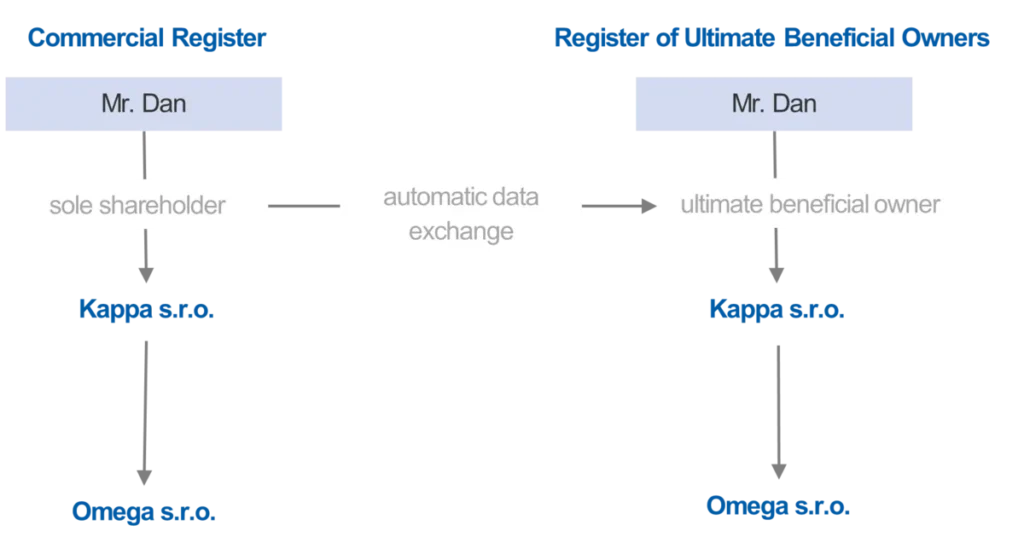

Automatic data exchange is a mechanism for transferring certain information from the Czech public registers into the Register of Ultimate Beneficial Owners. Natural persons registered in the Commercial Register in specific positions are automatically registered as ultimate beneficial owners given that specific legal prerequisites are met.

Example No. 3

Mr. Dan, a natural person, is a new 100% shareholder of Kappa s.r.o. Mr. Dan is listed as the sole shareholder in the Commercial Register. On the basis of the automatic data exchange, he is immediately listed as the ultimate beneficial owner of Kappa s.r.o. in the Register of Ultimate Beneficial Owners as well as the ultimal beneficial owner in Omega s.r.o. which is 100 % owned by Kappa s.r.o.

The Register of Ultimate Beneficial Owners is available on the website of the Ministry of Justice.

The Register of Ultimate Beneficial Owners is partially public. The information that is publicly available includes:

The ownership structure is not publicly available.

Full information about the beneficial owner, including the registration history, can be obtained by the following persons:

The court will publish a note on irregularity in the Register which may have a negative impact on the company by decreasing its credibility.

The private law consequences will occur independently of the irregularity proceedings; they are not tied to the court’s previous finding that there is an irregularity in the records.

These arise if:

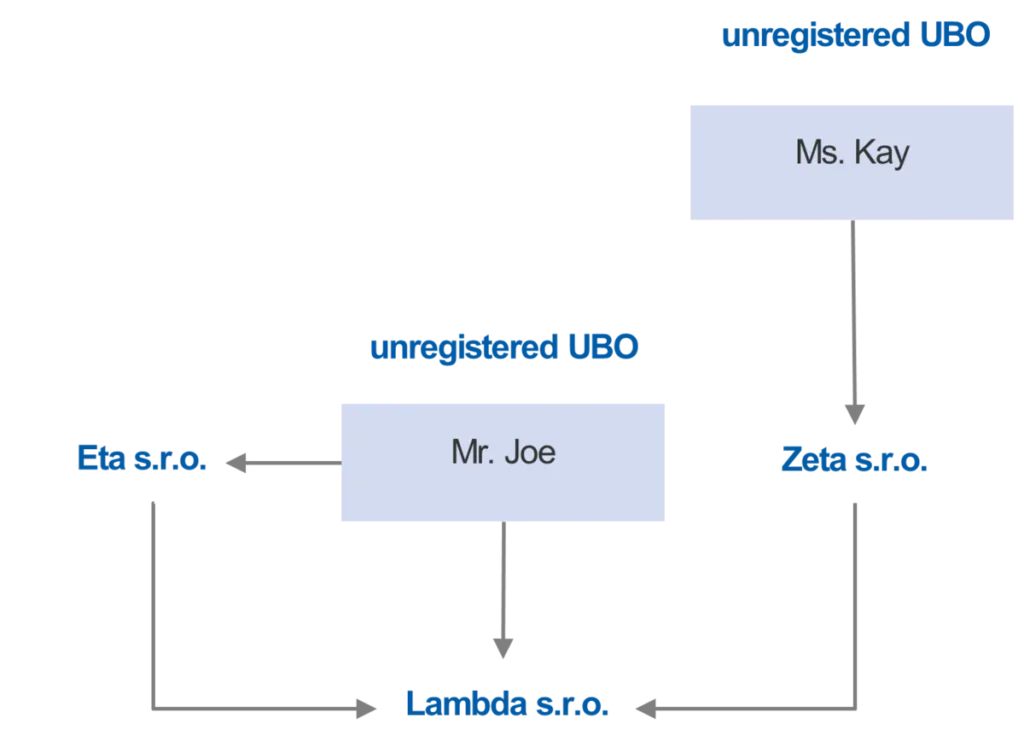

Hence, these measures particularly target the unregistered beneficial owners. If the beneficial owner is registered, but some of their details are inaccurately registered or not entirely up to date, the private law consequences do not apply. However, we recommend paying attention to two different scenarios that may occur:

Example No. 4

Ms. Ela is registered in the Register of Ultimate Beneficial Owners as the ultimate beneficial owner of Iota s.r.o., owning a 60% share in the company. Subsequently, Ms. Ela buys another share in Iota s.r.o., i.e. she now holds 80% of shares. If Ms. Ela does not update the information about her new share in the Register of Ultimate Beneficial Owners, the private law consequences do not arise.

Although the private law measures did not apply in our Example No. 1, we strongly recommend updating any changes concerning the ultimate beneficial owner or the ownership structure in the Register of Ultimate Beneficial Owners.

Example No. 5

Ms. Fay is registered in the Register of Ultimate Beneficial Owners as the ultimate beneficial owner of Sigma s.r.o., owning a 90% share in the company. Mr. Gus owns a 10% share in Sigma s.r.o. Hence, he is not registered as the ultimate beneficial owner. Ms. Fay sells 20% of her share to Mr. Gus, so Mr. Gus now owns 30%. Thus, Mr. Gus should be registered in the Register of Ultimate Beneficial Owners without undue delay. If he fails to do so, the private law consequences shall arise.

1. Unenforceability of concealing contracts (e.g. command contracts)

Example No. 6

Mr. Han formally transferred 100% of the shares of Gamma, a.s. to Mr. Ian but, at the same time, contractually obliged him to exercise all the rights of a sole shareholder according to his instructions for regular remuneration. Mr. Ian is formally registered in the public register as the only shareholder, but in reality, the rights of the shareholder are exercised indirectly by Mr. Han. If Mr. Han is not registered in the Register of Ultimate Beneficial Owners, the contract between him and Mr. Ian is unenforceable.

2. Suspended distribution of dividends

The company that does not have an ultimate beneficial owner registered in the Register of Ultimate Beneficial Owners is prohibited from paying out the dividends as in the situation described in Example No. 7 below.

Example No. 7

3. Inability of shareholders to exercise their voting rights

Suspension of voting rights at the general meeting (inability to make decisions on the most important matters of the company, e.g. change of the Deed of Incorporation in a form of the Notarial Deed, approval of the financial statements, change of directors etc.).

Who may have the voting rights suspended?

Example No. 8 (please, refer to the diagram in Example No. 7)

What are the consequences if the voting rights are nevertheless exercised and decisions are adopted?

Such decisions are deemed invalid. The invalidity of these legal actions can be claimed within a subjective period of 3 months and an objective period of 1 year.

There are other consequences the companies may face in the course of their business should they fail to proceed with the registration of ultimate beneficial owners (the list is not comprehensive):

Which legal entities are obliged to register their ultimate beneficial owners?

The obligation to register the ultimate beneficial owners is imposed on legal entities who have their registered office in the Czech Republic. This includes all types of corporations (unlimited partnerships, limited partnerships, limited liability companies, joint stock companies, European companies) and some cooperatives. Foundations, endowed institutions, and public benefit corporations must also register their ultimate beneficial owners.

Trusts are also obliged to register their ultimate beneficial owners. However, trusts do not have a legal entity status, and therefore the registration obligations fall on the trustee. If a trust has a trustee with their registered office or residence in the Czech Republic (which can be found in the public part of the Trust Fund Register), it should have, as a rule, its ultimate beneficial owner entered in the Register of Ultimate Beneficial Owners.

Legal entities which are not obliged to register their ultimate beneficial owner are listed on page 6 of this eBook.

Does a branch of a foreign company have to register their ultimate beneficial owner?

No, it does not. A branch is not a legal arrangement within the meaning of the Act on the Register of Beneficial Owners.

Who is the ultimate beneficial owner in the case in which a parent company is a company listed on a regulated market?

The companies listed on a regulated market are not exempt from the registration obligation. We either look for the ultimate beneficial owner (natural person) with ultimate ownership or control, or apply the alternative solution of registering the substitute beneficial owner (please refer to page 6 of this eBook).

What if the parent company / ultimate beneficial owner does not provide necessary cooperation?

If the parent company is from outside the EU, it is necessary for the registrant to explain the importance of the supporting documentation and, additionally, document that they have made reasonable efforts to obtain such information from the parent company / ultimate beneficial owner. If the parent company / ultimate beneficial owner does not provide the necessary cooperation, the registrant shall register the top management of the parent company or the top management of a company, which is one level under the parent company.

It should be noted that failure to provide the necessary cooperation, on the part of the ultimate beneficial owner / parent company / other companies within the corporate chain, can result in the court initiating the irregularity proceedings (for the reason of the irregularity on the part of the person obliged to cooperate, please see page 10), which in turn may affect other sanctioning mechanisms.

Will I receive any decision on the registration?

There is no decision on the registration. If the registration is successful, the registrant shall receive a full extract of the registering entity from the Register of Ultimate Beneficial Owners (including non-public information) It is provided either by a notary or a court.

Sign up and get free access to our expert knowledge and valuable insights. You can unsubscribe from our mailing list anytime. Check also how we handle your data: Privacy policy | GDPR statement.

Already subscribed? Confirm your e-mail address below and receive your PDF directly in your inbox.