Get free access to

Our legislation updates make it easy for you to keep on top of the latest changes affecting your business. Receive our articles, opinions, tips, industry news, country profiles, regional overviews and studies, latest events and even more, directly into your mailbox.

Check out our Newsroom to see what is included!

We will send you only relevant information we consider may be of your interest and treat your personal data in compliance with our Privacy policy and GDPR statement.

Unable to subscribe? Try this page.

IFRS Foundation published educational material to support companies in applying going concern requirements. In current pandemic, many entities face falling revenues and decline in their profitability and liquidity which raise the question about their ability to continue as going concern. Therefore, management needs to involve a greater deal of judgement as in preceding period that should be disclosed. Those disclosures are likely to be more relevant for users of financial statements, too.

IAS 1 stands that “An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no realistic alternative but to do so.“ Assessment is made for 12 months at least and includes:

Entity should also disclose any change in ability to continue as going concern in accordance with IAS 10 Events after the Reporting Period. If, before the financial statements are authorised for issue, circumstances were to deteriorate so that management no longer has any realistic alternative but to cease trading, the financial statements must not be prepared on a going concern basis.

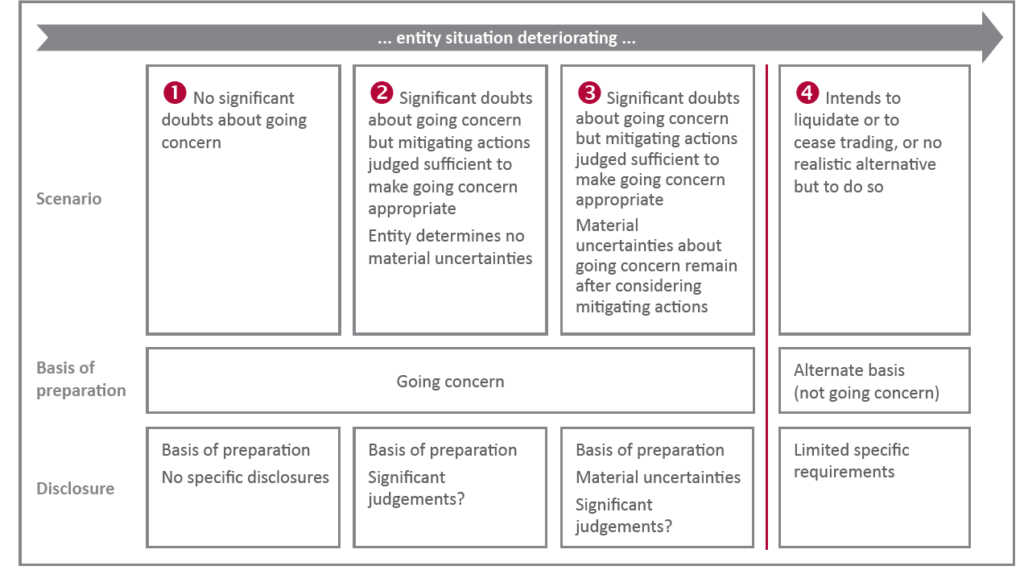

Possible situations when applying the requirements

The requirements in IAS 1 can be depicted as set out in diagram below*:

*IFRS Foundation – Going concern – a focus on disclosures, January 2021